This is a guest post from William Cowie. He’s a new personal finance blogger AND he’s helping out with the Plutus Awards ceremony this year. Enjoy his guest post!!!

O crap! Not again! Didn’t we just have one?

If any of those thoughts went through your mind when you read the headline, you’re in good company.

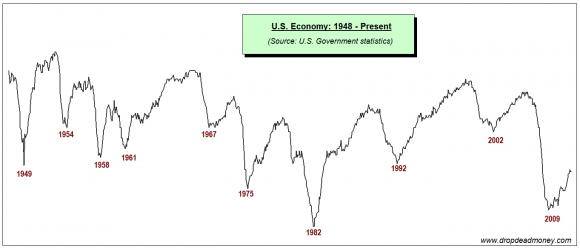

But let’s cut the hype and look at the facts. Here’s a chart showing the U.S. economy (based on employment statistics) for the last 70 years or so.

The dates in red show the bottom of ever recession we’ve had. Now look – how far apart are they? In our lifetime, 7-10 years. Look at the surprising consistency.

So… when would you expect the next recession?

Any time from 2016 on, right? That’s only 4 years away.

Believe it or not, that’s the good news. The bad news is more and more people are fretting that we might see a recession in 2013.

However, the mere presence of the bad news bears doesn’t necessarily mean we’re headed to disaster.

I believe in the cycle shown in the chart. Here’s the thing about the cycle: nobody can predict it, or even explain it. Every boom had a different reason and every recession had a different reason. Recessions happened with Republicans and Democrats as president. And yet those cycles moved like clockwork. So generally I don’t get swayed by the prophets of doom.

But… this time I’m not so sure. This time I’m thinking prophets of doom may be right.

Here are their reasons:

- Europe: Their economic mess is pushing our biggest trading partner into a double dip recession. We have no control over it, and it’s big enough that we can’t pretend it won’t affect us.

- China: their growth is slower than in the past. That affects us.

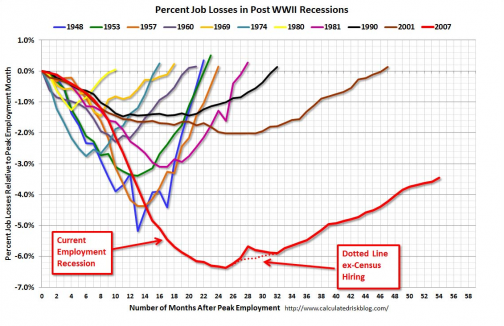

- Jobs: Here’s a scary chart for you:

photo credit: calculatedriskblog.com That red line shows how much longer it’s taking for jobs to come back this time round, compared to previous recessions. Experts are beginning to agree, and economists rarely agree on anything. Here’s a recent article in BusinessWeek where someone actually tried to say that we’re already in a recession.

- The fiscal cliff. That refers to tax increases and spending cuts scheduled to take effect on January 1, 2013. (After the elections, of course.) There’s a chance it may not happen, but it may. If it does, it will definitely take all the air out of the fragile economic recovery we’re in now. Nobody disputes that.

So, is the news all bad? No. It never is. Here are a few positives:

Small businesses (i.e. the most businesses) report rising revenues and profits. Hotel occupancy is up too. This is grass roots economy – millions of small business, from HVAC contractors to dry cleaners. And their business and profits are up, not down.

However, the recessionists say these recoveries are fragile and may run out of gas soon.

So, there’s enough opinion out there that we might hit a recession much sooner than usual for us to not blow it off.

So, What Do We Do?

Hurricane warnings allow us to prepare for hurricanes. The hurricane may still come (we can’t control that) but we can control its damage.

Same with recessions. Forewarned is forearmed. If you know it’s coming and you prepare, you can avoid the damage and even get ahead. How?

- Cash is king: You need an emergency fund. But you need more: you need an opportunity fund. Why? Because the best bargains are found in a recession. Recession is the best time to buy a house or car. It’s also the best time to invest, whether it be in stocks or real estate, even frivolous stuff like art or classic cars. But to take advantage, you need cash.

- Debt kills: Kill it first. Should you have your income cut by furloughs, layoffs or declining sales of your own business, you can cut expenses to a great degree. But you can’t cut debt payments. Best to have them out of the way as much as you can.

- Your employer: if you work for a company, pay careful attention to how recession proof they are. You don’t want to work for the next Circuit City. Read the trade press. If it’s a public company, check what Seeking Alpha says about them.

- Your job: do a realistic assessment on how layoff-proof you are. If you just punch a clock, you’re at risk. If you regularly do more than your job description, you’re a little safer. Are you the biggest earner in the department? You have a bulls-eye on your back. If you think you’re at risk, talk to your manager and let them know, casually of course, that if the worst happens, you’ll be flexible and take cuts in hours, share work with other departments, etc. If they know you’ll work with them, in most cases they’ll work with you.

- Network: The more people in your company (and industry) know you and think you do good work, the safer you are. My wife is an excellent worker. The department she worked in went from 80 people to 3, and she was one of the three. How? She stayed positive, flexible and helpful at all times. She only left when we moved out of state.

Develop something on the side. We live in an era where the internet is allowing more and more people to turn their hobbies into internet businesses. This could be blogging or a focused how-to website. Start now when it doesn’t need to support you. All businesses take time to grow roots, so it’s best to start when you still have a day job. Whether you switch on your own time, or it’s forced on you, you have nothing to lost by starting now. - In summary, we may get hit by a recession next year, or we may not. Much better to be prepared and have the storm pass by than not be prepared and get hit.

—

William Cowie learned the hard way that recessions can hurt, and the time to prepare is when it doesn’t seem necessary. He helps others manage their careers and finances on http://www.dropdeadmoney.com by exploiting the opportunities presented by the economy in both good and bad times.

William,

Great post! You do an excellent job of giving us the bad news while tempering it with comforting, useful advice. Thank you!

Deonne

Thanks, Deonne. We can’t control situations, but we can control our responses.

It worries me how not worried I am about the looming recession. I don’t have significant savings or anything (yet), but I feel that I will always come out on top no matter what. It is very possible I am just naive.

I have my emergency fund stocked and ready to go. I hope I don’t have to use it and I hope you are wrong but I am prepared just in casen you and the press are right.

I’m with you, Lance – I also hope the press is wrong. I remind myself it wouldn’t be the first time! 🙂

I still feel like we’re in a recession so to be hit with another one next year would be bad….really bad. I’m hoping that the recovery will pick up some steam and maybe the economy can hang in there another 5 years. Then I might be ready for another recession.

Little House, it’s not a sure things that we’ll see a recession. I personally am not sure we will. But enough people are saying we will that I’m preparing for it. It’s like stocking up your basement when you hear a tornado warning. If it doesn’t happen you don’t lose much. But if it does, you don’t want to be caught unprepared.

You’re right about preparations and reactions, but that doesn’t make the data any less scary to me! Time to beef up the savings account…

Hi there just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same results.

Hey Austin, the links work for me. Here’s what you can do, though: Depending on the browser you use, you can right-click on the image and copy the URL (Link location in Firefox). Then paste it into a new browser window.

Hope that works!

Cash is the most underrated and ignored asset today. Why wouldn’t it be with interest rates at zero? But cash has a correlation of zero with other investments and preserves capital in a bear market. Cash should be overweighted in investment portfolios now!