High school kids who need money for college spend hours upon hours filling out forms and writing essays to earn scholarships. Little do they know that the only thing they really need to submit is a marriage license form.

I got this crazy marriage idea from one of my favorite bloggers, Paula, at Afford Anything. Paula started her blog just a few months ago and it immediately jumped into my Top 3 favorite blogs, with the other two being Punch Debt in the Face and Budgets are Sexy. I think this is what you call “holla-ing at ya boyz.” Yeah, I’m pretty gangsta.

Getting back to the point, the biggest obstacle most young people face when they are looking for free college money is their parents’ income. A young single person (under 24) must report his parents’ income on his FAFSA when applying for federal student aid. The more his parents make, the less he’ll get in grant money.

What if he could leave his parents income off the FAFSA and only report the money he made at his part-time job serving scrumpdillyicous blizzards and shakes at Dairy Queen? He would look so poor, his financial aid package would increase by many thousands of dollars a year. If only there were a way…

There is! He just has to get married!

Get Married and Save Tens of Thousands

A young married man can claim himself as an independent on a FASFA as long as his parents don’t claim him on their tax return. That means his financial aid would be based only on his and his wife’s income, which should be as low as $0 and as high as a few thousand bucks as long as he picked the right wife.

This is a great plan in theory, but the problem for most people is that they haven’t fallen in love before they graduate from high school.

To that I say, “Who cares?”

Find a friend who also wants to save tens of thousands of dollars and do a quick justice of the peace ceremony. You don’t have to kiss, hug, or even touch your “spouse”. You really don’t have to spend a single moment with that person after all the legal formalities are taken care of. Just make sure you file your taxes as a married person for the next four years and the both of you can enjoy your gratuitously discounted college education.

Tips On Marrying For College Money

Here are a few things to keep in mind if you plan to marry someone for college money.

- Don’t Pick Someone You’re Romantically Interested In – This should strictly be a business transaction. If you start mixing emotions into this situation, you set yourself up for a potentially disastrous end to your marriage and your financial aid. Pick a stranger or someone you hardly know, and it’s probably best if you don’t even attend the same school or live in the same city. Don’t even think about doing this with a boyfriend/girlfriend.

- Pick Someone Who Doesn’t Work Much or At All – The less money your future spouse makes, the better. If you both work part time during the school year and full time in the summer, your combined income could get pretty high. Remember, the more you make, the less financial aid you will receive.

- Hire a Lawyer and get a Great Prenup – You might spend your four years getting a Chemical Engineering degree while your spouse makes it halfway through an Art History degree. If this happens, you want to make sure that crazy wife of yours doesn’t come looking for alimony to pay for her party years. It will cost a few thousand bucks, but it’s nothing compared to what you’ll be saving on your education.

- Make Sure Your Parents Don’t Claim You on Their Taxes – It would suck pretty hard to go through all the trouble of getting married and then realize you don’t get any of the benefits. Tell your parents about your plan and make sure they are on board.

- Marriage Can Help Establish Residency – If you are going to an out-of-state school, marrying someone in your new state will help you establish residency in that state and make your education bills even lower. Check with state rules; sometimes it is better to marry someone who already has residency in the state where you will be attending college.

- Talk About Potential Situations – What if one of you actually falls in love and wants to get married for real? What if one of you drops out of college but the other is still pursuing their degree? What if if takes the wife four years to finish her degree but the husband needs six? Answers to these questions should be written into the prenup.

- Health Insurance Isn’t an Issue – Thanks to Obamacare, you can stay on your parents’ health insurance until you are 26, even if you are married. You just can’t extend your parents’ benefits to your spouse.

Don’t Marry For College Money if…

I admit, this strategy isn’t for everyone. If you fit in one of the following categories, don’t even think about it.

- Your Parents are Already Poor – If you’re already in line for some generous financial aid packages based on your parents’ income, there’s no sense in becoming an independent.

- Your College is Paid For – Need-Based financial aid is for people who NEED it. A kid from a middle class family whose parents aren’t paying a dime for his college needs money. A kid from a middle class family whose parents are paying for everything doesn’t need money. Remember that any money you receive is money that could have gone to someone else who needs it.

- You Will Attend a Community College or Cheap In-State School – I strongly recommend hiring the lawyer and getting a solid prenup, which will be a significant investment. If you go to a cheap school, you’re probably better off paying your own tuition and avoiding the lawyer and marriage fees.

- You Can’t View This as a Business Transaction – If I had thought to do this in college, I would have seen it as a business transaction and would not have had any moral qualms with getting “married” and “divorced”. However, I know a lot of people can’t separate a romantic marriage from a legal one in their minds and hearts.

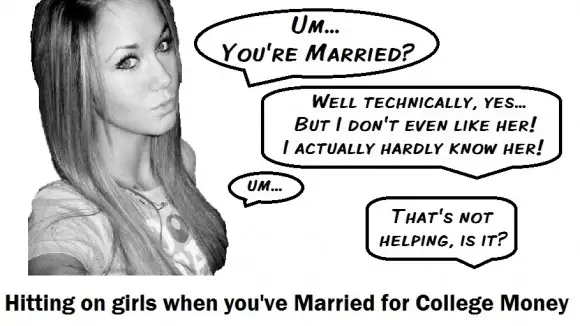

- You Aren’t Good at Talking About Your Situation – It could really put a damper on your dating life. For example:

A Creative Solution to a Common Problem

A lot of people are going to say this is morally wrong. I’m usually a moral stickler; I even think coupon sharing is stealing. However, there is no law that states a marriage must be based on love. A legal marriage is nothing more than a contract between two people if you choose to look at it that way. If this contract benefits you, then why wouldn’t you enter into it?

It really comes down to a simple decision; you can either sign a contract to enter into a financial relationship with Sallie Mae, or sign a contract to enter into a legal relationship with Joe/Jane Schmoe.

Your bank account is hoping you pick the latter.

Here are some of our top posts:

Joe Biden’s net worth is embarrassing

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Reminds me of Privates getting married in the Army to get out of the barracks.

Not a bad idea either. Although then they have to live together, and I feel like it becomes harder to separate the emotions from the business

But isn’t marriage supposed to be special and last forever?Save our children, the sanctity of marriage, the Bible, etc…

Wish I had thought of it myself. 🙂

I admit I wouldn’t get married in my church for this, but I would do it with a Justice of the Peace. 🙂

Hmm, pretty clever. I never thought of this angle!

When it comes to college debt all options are on the table, especially these days…

No kidding. I’m sure there are plenty of people who still wouldn’t be able to afford college even using this method.

Um, actually if you can pay for your own living expenses (rent, utilities, etc) then ANYONE can afford to go to college. It’s called a PELL grant! It’s FREE money that you never have to pay back and it covers tuition and usually books. Of course, anyone over the age of 22 (?) can qualify for gov’t financial aid without having to get married (as long as your parents don’t claim you on their taxes).

You do realize that only low income students are eligible for Pell Grants right? That’s the whole point of getting married; so you appear to be a low income student and qualify for aid such as Pell Grants.

And you have to be 24 to remove your parent’s income from your FAFSA if you’re not married, at which point most people are already done with college.

Yes, these days you never know what someone is going to think of and try. Although this option would never have been for me I could see why some would consider it.

Awww, I’m one of your three favorite blogs?! That was the nicest thing I’ve read in a long time! **blushing** Thank you! That made my week!

Love this post, especially all the tips you give on ‘how to do it’ and ‘how not to do it.’ And the comic is great; how did you design that?

I just used microsoft paint. I’m no graphic artist by any means; just slap a picture of a hot girl on there and make some speech bubbles.

this is very practical. goes back to the days when marriage was used as a political/ financial bargaining piece instead of something romantic/idealistic.

I think, if used correctly, it can be used as both at different times in a person’s life.

I knew this guy who got married so he could get a bigger relocation package from work. 🙂

Sure, why not. It’ll save a lot of money! You probably want to make sure your spouse isn’t going to rack up huge amount of debt. I believe that will screw up your good name too.

I’d make sure it is explicitly stated in the prenup that each person’s finances are separate. Don’t cosign on loans or anything, and accumulating debt shouldn’t be an issue. That’s why the prenup is so important.

This reminds me of people marrying other people in the military to get the extra pay and benefits.

Again, I’d just be worried that if you’re living with your “business partner”, it would be very difficult to not let emotions creep into the equation and mess everything up.

I heart this advice. Why, oh why did my husband and I shack most of the way through college?

Oh man. You had the opportunity and you didn’t take it. Although, it would have broken my rule of not marrying someone you are romantically interested in. There can always be exceptions, but I think it’s a really bad idea to do a business marriage if you have some degree of romantic involvement, but aren’t prepared for the romantic marriage yet.

Sad thing is we planned to get married the weekend we graduated for the last 2+ years of college. We just thought we were being responsible by waiting. Here’s the kicker – my husband played football and they took the wives for free on that trip. So I missed out on all of that money and a free honeymoon – which it took 8 years of marriage to finally afford.

I happen to think this is a great idea (even though it screams “fraud”) but then again, what does it matter?

I’m OK with the moral issue here, but wouldn’t this be considered fraud?

There are all sorts of marriages, domestically and world wide. And it’s not nearly as “”sacred” as so many romantics imagine. Marriage is, and has always been, nothing but a contract. And it has never been a promise of romantic bliss. Marriage solely for love is relatively new on the marriage scene, but well promoted by movies, novels, and other media.

This is not fraud, but sheer pragmatism.

True, but the government makes you prove you have a “real” marriage based on a relationship in order to get a green card – I’d expect they’d feel similarly about people getting married simply to get money from the government for school (although probably not enough to set up such an elaborate process as immigration)

This post made me lol. Nicely done Kevin.

Do I have any moral objections? Nah. Would I do it? Hmm… probably not. I’d just be scared of the negatives that could happen. Still, I’d love it if you could actually track down somebody who did this.

Um, nope. Call me a romantic! But I was watching yours and Well-Heeled comments – and I’d definitely DELAY marriage to save money. $10k a year? Hell yeah. I suppose if maybe I was in my 30s I might not feel the same way, but I’m not even 23 and have plenty of time to get hitched.

Alright, this was pretty darn funny and creative. I am following you now on RSS and heading over to Paula’s blog also. Now I am trying to figure out how to arrange a marriage for my daughter (LOL).

Wow… that’s interesting and very debatable… Especially if your in a state that allows same sex marriage… You could essentially “marry” your Best Friend and score a deal on tuition.

It would make the dating scene easier because it would be more obvious that it was for financial reasons.

My fiance is planning to go back to school this fall. For the past two years, he has been working and paying my student loans while I stayed home with the baby. I read that if i went back to school, I could defer my loans. If we were married and he goes back to school, could that defer my loans just as if I were to go back? Or is that a silly question?

Unfortunately you would have to go back to school yourself to defer your student loans. His school status won’t affect your loans.

Haha, hilarious! I don’t think I’d ever do it if I went back in life, but good food for thought!