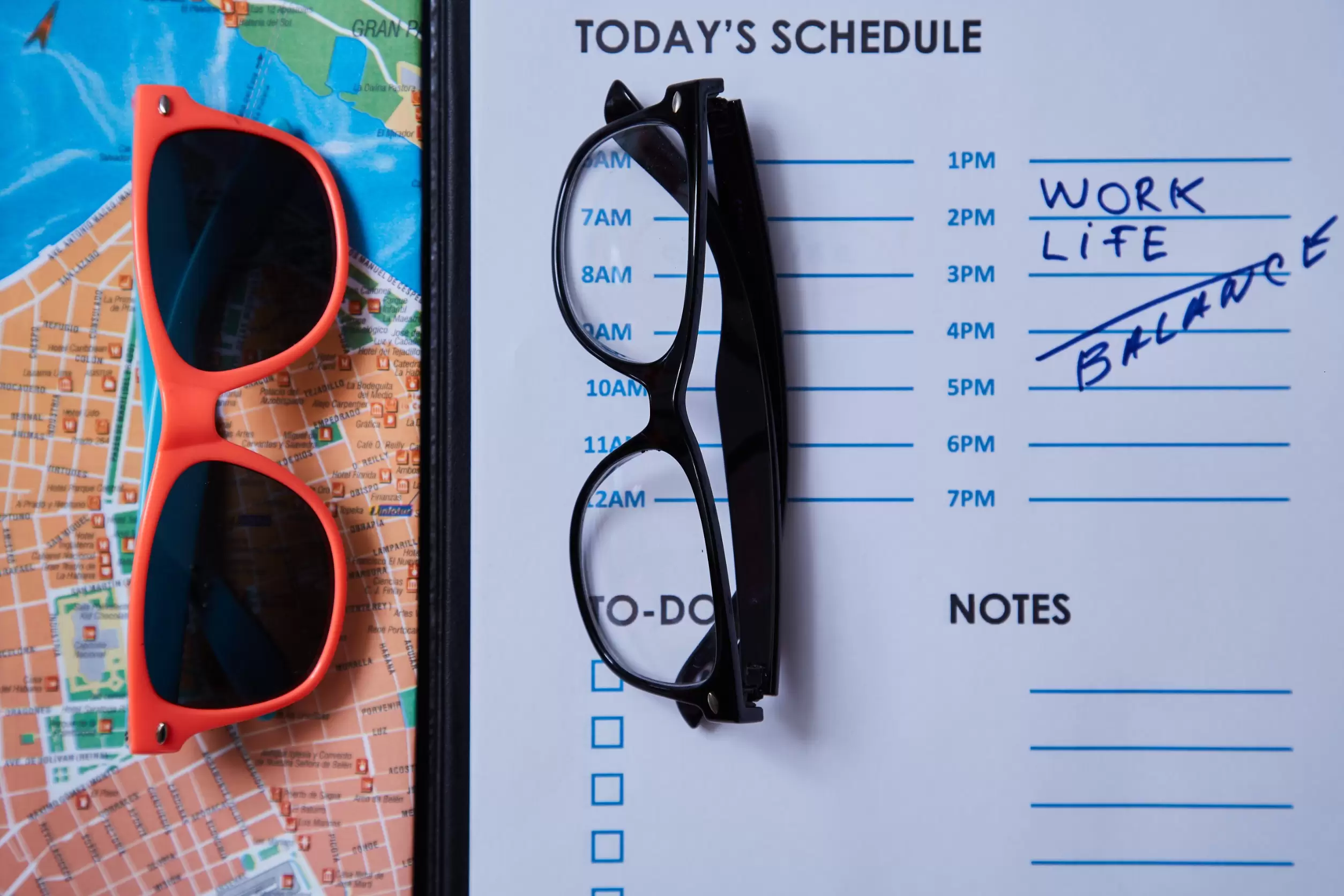

Phased retirement is becoming an increasingly popular strategy for those looking to gradually step away from their careers rather than all at once. This approach allows individuals to maintain a balance between work and leisure, easing into full retirement. Here are twelve practical tips to successfully navigate this transition.

1. Understand Your Financial Position

The first step in planning a phased retirement is to thoroughly assess your financial situation. Determine how much income you need to sustain your lifestyle as you reduce your working hours. Consider consulting with a financial advisor who can help you understand the implications of phased retirement on your savings, investments, pensions, and social security benefits.

2. Negotiate with Your Employer

Phased retirement requires the support of your employer. Start the conversation early about your plans and be clear about your goals. Propose a flexible schedule that meets both your needs and the needs of your company. Additionally, discuss options for adjusting your responsibilities or shifting to accommodate a part-time schedule. That ensures everyone is on the same page early in the process.

3. Plan for Health Insurance

One significant consideration during phased retirement is health insurance. If you currently receive benefits through your employer, determine how transitioning to part-time might affect your coverage. Explore options such as extending your employer coverage, switching to a spouse’s plan, or obtaining insurance through the marketplace.

4. Gradually Reduce Your Hours

The essence of phased retirement is the gradual reduction of work hours. Start by cutting back slightly, such as working four days a week, and adjust as necessary. This gradual step-down can help both you and your employer adapt smoothly to the change. As a result, it’s typically a win-win strategy.

5. Transfer Knowledge and Responsibilities

As you prepare to work fewer hours, it’s essential to ensure a smooth transition of your responsibilities. Plan to mentor a colleague or a successor who can take over your duties. This not only supports your team but also secures your legacy within the company, which is a nice bonus.

6. Maintain a Professional Network

Keeping in touch with industry peers and professionals is crucial during phased retirement. Continue attending conferences, workshops, and networking events. Staying connected can open opportunities for part-time projects or consulting work that complements your retirement lifestyle.

7. Explore New Interests

Phased retirement is an excellent opportunity to explore interests that you may not have had time for while working full-time. Whether it’s a hobby, volunteer work, or a part-time job in a field you’ve always been interested in, now is the time to explore these avenues.

8. Set Clear Boundaries

As you transition to fewer working hours, it’s crucial to establish clear boundaries with your employer and colleagues. Be firm about your availability and the scope of your work. Setting these boundaries early on can prevent misunderstandings and ensure that your phased retirement is respected and successful.

9. Adjust Your Lifestyle

Reducing your working hours will likely require some adjustments to your lifestyle. Evaluate your spending and adjust your budget to fit your new income level. Embrace this as an opportunity to simplify and focus on what’s truly important to you.

10. Keep a Structured Schedule

Even though you are working less, maintaining a structured schedule can help you manage your time effectively. Allocate specific days for work, leisure, and other activities to keep a balanced and fulfilling routine.

11. Plan for Full Retirement

While enjoying the benefits of phased retirement, don’t lose sight of your ultimate goal: full retirement. Understand what your ideal exit from the workforce entails and ensure that you are on track to retire completely when you choose.

12. Monitor Your Progress and Adjust as Needed

Finally, assessing how your phased retirement is going is essential. Are you achieving the balance you hoped for? Are your financial needs being met? Take time to review your situation annually and make adjustments to your plan as necessary to ensure it continues to meet your evolving needs.

A Phased Retirement Is Often a Wise Move

Phased retirement can be a rewarding and smooth transition to full retirement if planned and executed well. By following these tips, you can ensure that you enjoy this new phase of life while still contributing meaningfully to your field and securing your financial future.

Read More:

The New Retirement Age: 12 Reasons Baby Boomers Are Working After 70

11 Tips to Avoid Financial Regrets During Retirement

Catherine is a tech-savvy writer who has focused on the personal finance space for more than eight years. She has a Bachelor’s in Information Technology and enjoys showcasing how tech can simplify everyday personal finance tasks like budgeting, spending tracking, and planning for the future. Additionally, she’s explored the ins and outs of the world of side hustles and loves to share what she’s learned along the way. When she’s not working, you can find her relaxing at home in the Pacific Northwest with her two cats or enjoying a cup of coffee at her neighborhood cafe.