I signed up to host the Carnival of Money Pros for a few reasons:

- I like to read other personal finance articles but don’t do it as much as I would like

- It helps build SEO for this site

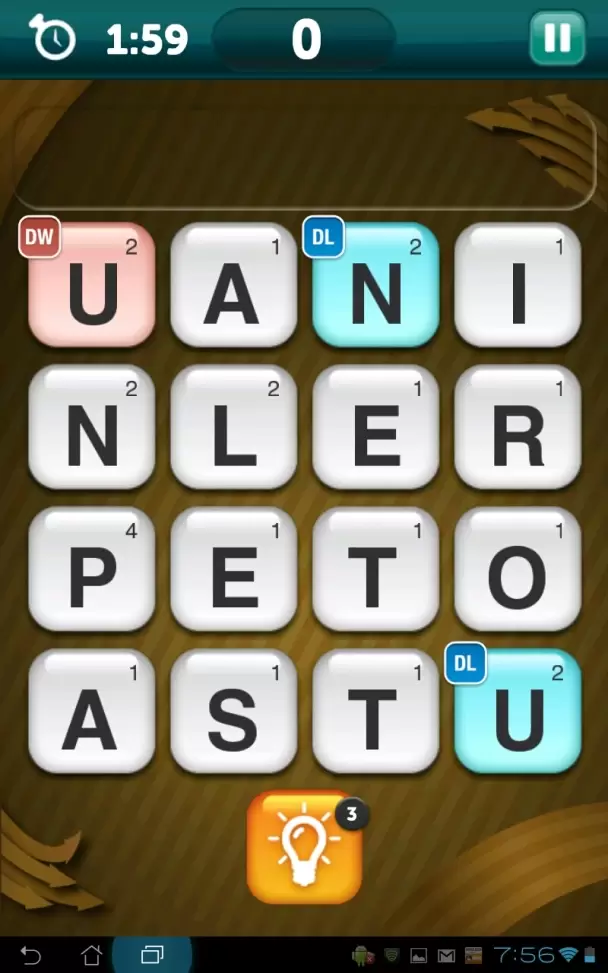

- I was too busy playing Scramble With Friends to write an article

Last week I only posted three articles, which is very low for me. I usually post four or five. However, I’ve been working on building a new website and that is taking a lot of my time. Any other free time I have has been spent playing Scramble with Friends.

Last week I only posted three articles, which is very low for me. I usually post four or five. However, I’ve been working on building a new website and that is taking a lot of my time. Any other free time I have has been spent playing Scramble with Friends.

I know a lot of people like Words with Friends (scrabble on your smartphone), but I find that game incredibly frustrating. I never want to lose so I always overthink my plays. When I know it’s my turn I feel all this pressure to play quickly and also get something good. Even though I play Words with Friends sometimes, I kind of hate it.

Enter Scramble with Friends. It has been out a while on iPhone, but it recently was launched on Android. It’s basically Boggle for your smartphone. You play 3 rounds of two minutes each and you’re done. It’s fun. It doesn’t stress me out. You play with friends so I don’t feel like as much of a loser as when I play Angry Birds.

It’s awesome!

So check out some great personal finance articles below. Or just download Scramble with Friends and post your username in the comments and I’ll play you!

Carnival of Money Pros

Jefferson @ See Debt Run writes Habit Creep – As you make changes to your spending patterns, you have to watch out for old triggers of bad habits. If you aren’t careful habit creep can sneak up on you.

SB @ One Cent at a Time writes Gold Vs. Silver, What is the Better Investment? – As of late, a big question on precious metal collectors’ and investors’ minds is this; what’s the better investment, gold or silver? I tried to provide rationale

SB @ Finance Product Reviews writes Capital One InterestPlus Savings Account Review – CapitalOne InterestPlus checking account review. Earn interest on your checking account now.

Glen Craig @ Free From Broke writes New Technology Makes Shopping With Your Credit Card Easier – Using your credit card is getting easier thanks to new technology. See some of the new technology that is making it easier for you to shop and get deals with your credit card.

Dr. Dean @ The Millionaire Nurse Blog writes 7, No 8 Ways I Waste Time! – Busy? We’re all busy. Could we make better use of our time? Absolutely. Here’s a breakdown of the ways I spend a large part of my time. Could I be more frugal and therefore more productive? I want to try.

Brandon Crombar @ Shared Financial Success writes David Bach’s Latte Factor – Saving small amounts of money over a lifetime all by its self can make you a millionaire.

Amanda L Grossman @ Frugal Confessions writes Keeping All Your Eggs in One Basket is Risky – My sister and I used to gather eggs from our henhouse for breakfast.

Steve @ Money Infant writes Getting Back on Track After a Financial Train Wreck – It took ruining my marriage and the destruction of my credit to get me to realize how I was managing my finances was unsustainable.

LaTisha @ Financial Success for Young Adults writes I Graduated, but Don’t Have a Job – Are you a recent grad without a job? This post has tips on how to land a job after college graduation. Smart networking tips for recent graduates.

Jen @ Master the Art of Saving writes How to Setup Daily Transfers at ING Direct – After mentioning numerous times that I setup daily transfers to help us save money, I figured it was time to share how to do it for those who don’t already know as well as any easy way to keep track of them. It’s quick, easy and a great way to get started saving money.

Wayne @ Young Family Finance writes Eating Healthy Can Save You Money – Believe it or not, eating healthy can save you money. Find out how by reading this article.

Suba @ Broke Professionals writes Five Things You Must Know About Freelancing – Freelancing can be a path to professional freedom, but if you’re not careful, life as a freelancer can complicate your finances.

MR @ Money Reasons writes Your First Investment Should Be Fun And Exciting! – When you start investing, doing so in retirement accounts is a killjoy! This is why I didn’t follow the common knowledge when it came to my first investments

Jeffrey @ Money Spruce writes Life After Quitting Questions Answered: Saving, Business-Building and More – Planning to quit your job means there’s a lot of things to think about first. Here some of those things you need to consider.

Corey @ 20s Finances writes My College Mistakes Everyone Should Avoid – My college experience was a blast and I learned a lot of financial lessons the hard way. I believe college students grow and mature faster as college students then most other times in their life. Students arrive on campus pumped up for all the good times to come, so oblivious to their responsibilities.

Kyle @ The Penny Hoarder writes How to Get Paid $200 a Month Testing Websites – Website testers are paid $10 to record their opinions of a website’s appearance and ease of use. It’s a pretty easy job and there a number of firms currently hiring…

MMD @ MyMoneyDesign writes Would Dollar Cost Averaging Have Saved You From “The Lost Decade”? – The S&P 500 decreased by 23% during “The Lost Decade”. Would the strategy of dollar cost averaging have saved your investment portfolio from being reduced by this much? Let’s crunch the numbers and find out for ourselves.

krantcents @ KrantCents writes The 3 J’s of Success – The 3 J’s of Success is the tenth in a series of articles to help you reach your goal.

PITR @ Passive Income To Retire writes Can only the Rich Retire Early? – Who can afford to retire early? Popular media may suggest it is the rich, but I think you will be surprised to find out who it really is.

Jester @ The Ultimate Juggle writes How to Get a Second Job – Find out what you should consider when selecting your second job. Don’t jump in without considering these options.

Tushar @ Start Investing Money writes Why Do Companies Have IPOs? – Read about the reasons why companies have IPOs. If you were every curious, here are the reasons.

Crystal @ Budgeting in the Fun Stuff writes In Praise of Hand Me Down Toys – I’ll admit it. I’m a cheap (but proud!) Aunt. One of the older nieces hands down her toys to the youngest via me.

Luke @ Learn Bonds writes 10 Year Treasury Going to 1%? – Bond fund manager Robert Kessler making the case that the end of the bull run in treasuries is not over, and in fact could have a lot farther to go. Here are his main points…

Kevin @ Thousandaire writes How To Turn Your House into Income – If you want to make some money off your house, consider renting out a room. That way you keep your place to live and make some money of it at the same time.

Ryan @ Early Retirement Investments writes Common Sources of Retirement Income – There are many sources of retirement income! See if you are considering the ones that I have on my radar.

John @ Married (with Debt) writes Stress at Work? Take an Office Vacation – Experiencing stress at work? Find out how to reclaim part of your day and take a vacation in your office. It’s not hard.

Don @ MoneySmartGuides writes Using Your HSA as A Retirement Account – As the price of insurance continues to increase, Health Savings Accounts (or HSA’s) are becoming more and more popular.

A Blinkin @ Funancials writes Friends Don’t Let Friends Ignore Inflation – Lets say you have two friends. One of your friends keeps stealing money from the other. Wouldn’t you feel an obligation to warn your one friend about the other? Of course you would! It’s the same obligation I feel when I think about your money and inflation.

Daisy @ Add Vodka writes Six Annoying Work Personalities We Could All Do Without – Since being thrust into the office work world in March 2011, I’ve noticed some pretty annoying office behaviours that I think are both mind-blowingly aggravating as well as comical.

Pat Huddleston @ Investor’s Watchdog writes Another Recidivist Headed for a Time Out – What to watch out for when trying to pick someone to watch your money.

Kevin @ Viaticus writes Gas Craziness – Gas prices are on the rise and could top $5 by summer. When you have to fill up, this post discusses several ways to ease the pain at the pump.

YFS @ Your Finances Simplified writes How Friends Can Ruin Your Finances – Have you ever had the kind of roommate that eats everything in the fridge even though he didn’t buy the groceries, or come up short on rent and ask you to cover for him? Most guys are familiar with the slacker roommate or flakey friend who is always a …

Shaun @ Smart Family Finance writes Should Families Buy a House or Rent an Apartment: The Risks of Homeownership Compared to Renting – Understanding the risks of homeownership can also help you implement strategies to reduce those risks.

Ashley @ Money Talks Coaching writes Why the Roth is Better Than a Traditional IRA – The difference between Traditional IRAs and Roth IRAs are taxes.

Jeremy Waller @ Personal Finance Whiz writes Credit Cards Are Dangerous: The Psychology Of Paying With Cash – Over the years I’ve discovered that knowing how to manage your money is only 20 percent of the picture. The biggest part, by far, is the mental battle. If I could sit down with you for 1 hour I could teach you everything you need to know to budget your money, pay off debt, invest and retire well…

Corey @ Steadfast Finances writes What are the Political Risks of Your Retirement Plan? – Is your retirement plan secure? Find out if it is at political risk.

Hank @ Money Q&A writes Five Creative Ways To Fund Your New Small Business – So, what does a small business owner have to do to find funding for his or her business? Get creative to fund your new small business. It takes a lot of guts to run a small business these days.

101 Centavos @ 101 Centavos writes Prospect Generators in Mining – The Global Outsourcing Trend Continues – American Airlines is looking for partner airlines to manage flight route out of the U.S. Oil and Gas refining companies outsource their engineering,…

FG @ Financial God writes How Kickstarter and the Point Are Great Ways to Give to Others, and Sponsor Some Really Cool Projects – Have you ever used Kickstarter or The Point before? These are a couple of pretty cool websites that are changing the face of charitable giving, and encouraging entrepreneurship by making it easier to support projects and sponsor creative works of art. The way that these sites work is that you “pledge” your support for certain projects.

Jason @ Work Save Live writes Athletes That Went Broke & Wondering Why We Enjoy Their Downfall – The idea for this post came from an article I read online about Allen Iverson being the next big name athlete to go broke.

Eddie @ Finance Fox writes 8 Tips to Save Money on Gas – If you’re looking for some ways to shave a few dollars off your household spend, one possibility is to spend less on gas, by following some of these fuel economizing tips.

KT @ Personal Finance Journey writes Money Saving Tips when Hiring Movers – If you are like me, you detest moving. I stayed in an apartment two years longer than I should have because I so dislike the moving process. Still, most Americans average 11 moves in a lifetime. If you are planning to move soon, take advantage of these tips to save money hiring movers: Check Yelp.com.

Aloysa @ My Broken Coin writes My Mother Was a Mail-Order Bride – People often ask me how I came to the United States. Sometimes they give me an unpleasant smirk, wink at Beaker, my American husband, and say nothing but imply a lot. Sometimes they go as far as measure me up and down, and blatantly ask me if I was a mail-order bride.

SFB @ Simple Finance Blog writes Choosing The Right Life Insurance – Buying Life insurance is an important choice that many people delay because of the overwhelming amount of options and lack of facts.

Jon Rhodes @ Affiliate Tips writes How To Make Money With E Books – This article illustrates ways you can make money online by selling e books. There is also a guide as to how to make an e book, and where to sell it.

Jon the Saver @ Free Money Wisdom writes Buy Disability Insurance or Go Broke! – Disability insurance is a topic that most people don’t know much about. It can protect your income in times of crisis during your life!

Jeremy @ Modest Money writes Folly Of Paying Someone To Cook For You – As I start preparing my income tax documents for last year, I have been struggling to come to terms with how I managed to waste so much money. Not only did I manage to spend a lot of money, I also have very little to show for it. One major expense was a vacation I took last year, but that doesn’t come close to accounting for all the wasted money. A bigger expense that I need to accept is dining out and take out food.

Dividend Ninja @ The Dividend Ninja writes Dividend Fund Managers Are Buying Apple? – written by Hank Coleman Mutual fund managers are getting confused. It seems like more fund managers are deviating from their fund’s stated focus and suffering from style drift in order to own one of the hottest stocks of the past decade. More than 40 dividend funds have recently bought shares of Apple even though the company does not yet issue a dividend.

Daniel @ Sweating the Big Stuff writes Are Company Sponsored Trips The Best Perk Ever? – My favorite perk at my job has been half day Fridays. Recently, I went on a ski trip and to a shooting range with the company. Which perk is better?

Karl @ CultOfMoney writes Complaining – the art of getting what you want – Be nice. Be considerate. Tell them what the problem is, what you were expecting from the product or service, and that you are disappointed. Be understanding, stating that you know errors and mistakes can occur, and that if you didn’t bring it to their attention, they wouldn’t have known there was a problem. Be firm that you’d like compensation.

SB @ One Cent at a Time writes 20 Tips To Be Productive And Happy At Work – There are few adjustments which can make you a high achiever at work, they don’t cost any money or any significant time. Learn 20 such tips here and become a high achiever today.

Lina Zussino @ Baby Alerts writes Top 10 baby items we’ve decided not to purchase for the new baby – Here is a list of the top ten items we have decided not to purchase for our new baby. Our decisions have been based on ideas and advice provided by parents, friends and family whom have been there and done it.

Steve Zussino @ Grocery Alerts writes 1 Whole Pork Leg, 45 meals, Under $23 bucks – Meat is one of the most expensive items we buy at the grocery store. I bought a whole pork leg and I managed to create 45 servings approx., with $22 and 30 minutes of work.

Pam Whitlock @ The MoneyTrail Blog writes How Mickey and Shamu are Teaching My Child about Loans and Debt Repayment – My son wants to go on a $300 optional school trip to Orlando. We are letting him go but he must pay for it himself. We have set up a loan repayment system for him!

Investor Junkie @ Investor Junkie writes 7 Great Apps from Online Brokers – If you have a mobile device, you can trade from wherever you are — as long as you have access to your online broker. Here are 7 great apps from online brokers:

Steven Zussino @ Canadian Personal Finance writes 6 Cities, States, or Provinces That Will Pay You To Live There – In the face of declining or slowing population growth, some cities have decided to get aggressive about their survival for new tax revenue. Some cities are giving away free land, while other states and cities are literally handing out stacks of cash to folks who agree to move. Here are the 6 cities that really, really want you to move there!

Paul Vachon @ The Frugal Toad writes A Guide: Peer-to-Peer Car Share – The average automobile sits idle 92% of the day and costs an average of $7319 to own, operate, and maintain each year according to the AAA. Peer-to-peer car share allows people to rent their own vehicles to others when they are not being used.

Kraig @ Young, Cheap Living writes Does Clutter Cause Stress? – I reflect on my apartment, office at work and my car on how their sense of simplicity and lack of “stuff” calms me. How does your living and working spaces make you feel?

Echo @ Boomer & Echo writes Why Leasing A Car Makes Sense For Young Families – Let me start off by saying that young families shouldn’t be fooled by lower lease payments. There are, however, some advantages to leasing a car.

Linsey @ 1099 Mom writes 5 LinkedIn Tips You Should Be Using Already – I’m sure you already have a LinkedIn profile. If you don’t, stop everything and put one up now. Then follow these simple and ridiculously-effective tips you may have overlooked in marketing your business on LinkedIn:

Dave Hilton @ Debt Black Hole writes My Infamous Cereal Aisle Meltdown – How do you react under financial stress? Ever freaked out over something silly? Here’s one of my stories…

Glen Craig @ Free From Broke writes Did You Get a 1099-K Tax Form This Year? – You might be asking yourself – What is the 1099-K tax form I received and what am I supposed to do with it? See what the 1099K is and why some people receive it.

Mike @ Rewards Cards Canada writes MBNA WorldPoints MasterCard Review – The MBNA WorldPoints MasterCard is a no fee card that still offers generous rewards points and the flexibility to redeem your points for pretty much anything you want.

Mike @ Rewards Cards USA writes Annual Fee Credit Cards Might Be Worth The Cost – One of the bits of advice consumers are often given about credit cards is to avoid those with annual fees – at all costs. In some cases, though, annual fee credit cards can be worth the cost.

J.P. @ Novel Investor writes Financial Emergency Kit: Are You Prepared? – Emergencies happen every day. But when the impossible happens, will you be ready? Having a financial emergency kit will make a big difference if the worst should ever happens.

Emily @ Evolving Personal Finance writes Why You Should Save for Retirement While In Graduate School Part 1 – The power of compound interest clearly lies in the length of time you allow the investment to grow. If a typical graduate student on a stipend saves 10% into a tax-advantaged retirement account during her PhD, her balance will grow to nearly $700,000 at age 65 without any additional contributions.

Ken Faulkenberry @ AAAMP Blog writes Fundamental and Technical Analysis: What is the Difference? – Investors who understand and use both fundamental and technical analysis can increase their probability of making wise investment decisions.

Sicorra @ Tackling Our Debt writes Let’s Talk Money – The Series – A weekly written interview with other personal finance bloggers who share personal information about themselves and their views on spending money, making money, budgeting, etc.

Kari @ Small Budget Big Dreams writes Does Clutter Cause Chaos – Does clutter cause financial chaos in your life? Clean out the clutter to simply your finances and your life.

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Thanks for adding me!

Thanks for including me in the list! I haven’t started playing any of the word games yet because I just know that my productivity will plummet! However, this game sounds intriguing. I’ll let you know if I jump in!

Thanks for the inclusion and hosting, Ireally appreciate it.

Thanks for the inclusion!

Thank you for the inclusion and hosting.

Thanks for including my post Kevin. If I had a smart phone, I’d definitely be up for the Scramble challenge. Thinking about it, maybe it’s a good thing I don’t have a smart phone yet. That sounds like a distraction that I’d let take up way too much of my time.

Thanks for the inclusion in the carnival this week.

I have not played Scramble with Friends but I usually play Scrabble (was free a few weeks ago).

Thanks for including me! I linked up to this post in today’s article!

http://www.1099mom.com/2012/03/1099-top-10-how-do-you-find-great.html

I’m honored to be included this week! I’ll link back on Thursday! Thanks!

Thanks for hosting!

So that’s what I have to look forward to when I get an iPhone, huh?

Thanks for including my post. I haven’t played any of the games on the smart phones, but it does sound like it would be fun.

Thanks for the inclusion!

Thank you for including posts from both my blogs. Appreciate it a lot!

Thank you for including posts from both my blogs. Appreciate it a lot!

Thanks for hosting!

Scramble is big where I work at, but since I don’t have a smart phone, I don’t play… yet! I hope to get one soon (smart phone that is).

Thanks for hosting and for including my post!

Thanks for hosting this week, it looks like quite the number of articles you had this week! And thanks for including me too.

Thanks for the wrap! Haven’t played that game on my phone yet…

I wish I had a smartphone to play the fun games!

Thanks for hosting and including me!

scrabble with friends is hit now a days..many are addicted with that game..i used to played that game in my phone..my friends and i played that game together specially when we are out of town..we use ANAGRAMMER to give us some hints..http://www.anagrammer.com/scramble-with-friends/

Thanks for including my post. 🙂