Since we had a great deal of market volatility last week I thought this would be a good time to remind everyone that unless you are taking your money out of the stock market soon a market crash is generally go

Since we had a great deal of market volatility last week I thought this would be a good time to remind everyone that unless you are taking your money out of the stock market soon a market crash is generally go

od news for you. This is even more true if you are a net purchaser of stocks going into the future. Every stock is partial ownership of an actual business. If business goes south, that’s bad. If just the stock price goes south, all that means is that you can buy the same percentage ownership for a lower price. You’ve probably heard this before. Many financial bloggers enjoy pointing it out. Stocks are on sale, they say. They’re right. Market drops are great for net savers, which I hope most of the readership is. The lower market prices are, relative to current book value and future profits, the better off you are.

What about people who aren’t buying, just holding?

Let’s say that you and a friend make a bet. Let’s say you think Verizon will do better for investors over the next 15 years, and he thinks AT&T will do better. You agree to both reinvest your dividends. The winner is the person with the most money at the end of the bet. For simplicities sake let’s suppose that the dividend yield of each is exactly 5% rather than the 4.87% and 5.88% that they are currently at. The day after you make the bet disaster strikes, Verizon shares go down 50% in one day, for no discernible reason and AT&T shares stay flat. Worse yet, Verizon shares stay down for all 15 years, and AT&T shares stay at basically the same level for all those years. In fact, both businesses earns the same profits for the next 15 years, and their dividends stay exactly the same. The only difference is that on day one your shares fell 50%. Who wins the bet?

Well clearly you wouldn’t be asking if my friend won, so what gives? How is that possible?

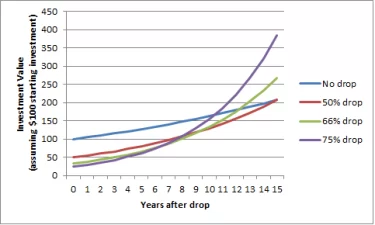

You win by a small margin about 1% of the size of your original investment. It was a benefit to you that the stock fell on that first day, and its too bad that it didn’t fall further, because then you might have crushed your friend. When you reinvested your dividends you were buying twice as much future dividend income as your friend was, that extra dividend income made up for the 50% drop on the first day. Not only that, but based on a $100 initial investment you are currently collecting about $21 in annual income, while your friend is only collecting about $10.

Bigger crashes are better

If you look closely at the plot you’ll notice the larger drops catch up quicker. This is counter-intuitive, but true. The bigger the crash, the better. If that Verizon stock only fell by 1% you wouldn’t have caught up in time (maybe for centuries). This is because the lower the stock falls, the higher its dividend yield is. Since returns are compounded each additional percentage point of return is worth more than the last one. Now all of this only really applies assuming that the market is basically dropping for reasons that are unimportant. It is quite likely that if a business is doing bad, their stock price will deteriorate. That isn’t good. Every stock price deterioration isn’t evidence that a business is doing badly. This also applies to the stock market as a whole. I find it very difficult to believe that the actual future expected value of the businesses in the US swung by trillions of dollars over 5 days. Hopefully, all that happened was that some of your stocks issued dividends and they were reinvested at relatively lower prices.

Adam Woods is a physicist. His research interests include building software to run and build geomagnetic models. Adam got interested in personal finance in the great recession when it became obvious an interest was necessary.

After harassing his friends and family (and a short intervention) he took to the web where he blogs about finance, investment, politics, and economics.

Adam is currently located in Boulder, Colorado where he can generally be found hiking, biking, or running a D&D campaign. He can also be contacted at adamwoods137@gmail.com.