Personal finance education is often called the key to increasing the financial stability of millions of Americans.

Financial literacy is not just about being careful with your money and avoiding emotional purchases. It is, above all, about forming good financial habits and using them to build financial well-being.

Consider these alarming figures:

- 23% of American adults are unbanked;

- 65% of customers in the United States live paycheck-to-paycheck;

- 13% of people in the U.S. struggle to pay their bills;

- 14% of employees aged 45–54 have less than $1 thousand saved for retirement.

And this is happening in the country with the world’s leading economy!

On a nationwide scale, a financially literate society means:

- less corruption,

- fewer homeless people,

- more happy families,

- a stable economy.

The country should be interested in the financial well-being of its citizens, but the financial well-being, in turn, depends on financial literacy.

There are so many financial instruments available exclusively in the United States, and yet, a lot of people aren’t even aware that they exist. Defined contribution plans, guaranteed income annuities, cash-balance plans – the list goes on and on.

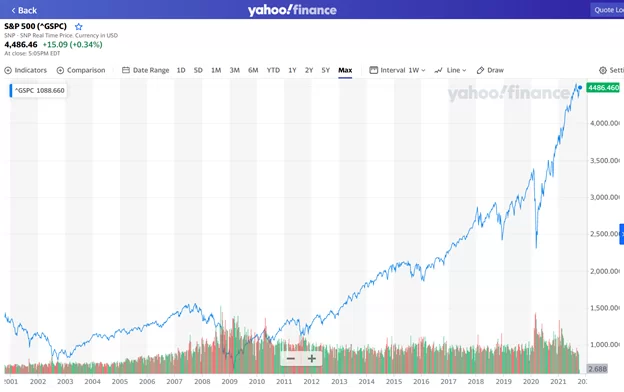

If this sounds too complicated, consider the S&P 500 index, which has been known for ages as a vehicle that generates 7 percent annually (inflation-adjusted).

It would only take one lesson to tell the kids what the stock market and index investing are all about. And one piece of such knowledge, if applied in practice, could radically change the life of a person and their loved ones.

Given this, it’s hard not to be surprised that 44% of American adults don’t own a single stock!

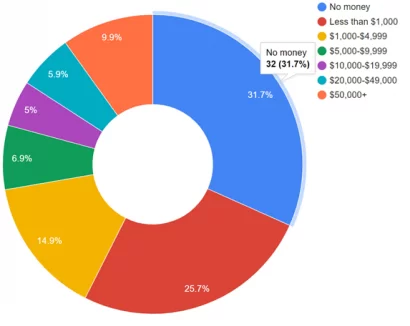

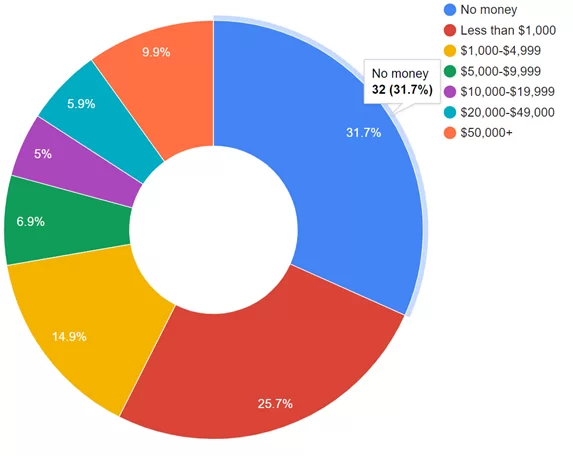

GoBankingRates conducted a study and realized that nearly about 70% of Americans keep less than a thousand dollars in their savings accounts.

Leading Principles of Effective Financial Education

While each of us can study personal finance from books, blogs, YouTube, or other sources, the role of government should not be overlooked.

However, finance is taught mostly in higher education institutions. And the educational process uses such complex terminology and such distant examples that many academic people simply cannot retell simple things in simple words.

It’s a comical situation. While millions of Americans need to study personal finance, in some cases from scratch, other people need to master unlearning and simplification!

Therefore, it is not surprising that many people prefer to gain knowledge not through government programs (do they even exist?), but from individual experts, financial consultants.

Effective Financial Education should be based on five principles:

- Identifying an audience is ridiculously important. It’s one thing to teach a school student about different ways to make and save money, and quite another to explain to an adult why he or she should or should not invest in a particular stock. Different people have different needs and are in different life circumstances.

- Providing relevant information refers to using proven ways, techniques, and approaches when it comes to teaching finance. With so many so-called ‘gurus’ out there, it is really easy to get overwhelmed. In our fast-changing world, a good book can get outdated before it is even published!

- Helping people to carry out their intentions using the context as a clue is a powerful technique designed to create a specific environment that makes it easier to consume difficult terms and pieces of knowledge.

- Designing effective education programs must be a number one priority. At school, they teach us the rules of an isosceles triangle and things a lot more complex than the Pythagorean theorem. But many school districts in the United States start teaching personal finance only in high school, when a student, whether consciously or unconsciously, has already formed an attitude to such concepts as money, savings, budgeting.

- Teaching and improving key financial skills such as setting up a budget, long-term financial planning, managing credit cards, balancing a checkbook. These are skills that modern people cannot live without.

Why Teaching Personal Finance Is Challenging?

A person’s financial literacy is one of the most important qualities of a modern citizen. The reason is that everyone is a participant in market relations.

Financial literacy implies broad theoretical knowledge as well as practical abilities and skills.

Worth being mentioned, one of the conditions of human financial literacy is the ability to streamline their expenses, keep records, as well as to manage personal finances.

It doesn’t necessarily mean that a financially literate person is always thrifty and refuses to buy what they like.

This idea is very much like what is known as work-life balance. That you have a family, doesn’t mean that you cannot be a diligent employee or employer. The same is true when it comes to personal finances. Saving and investing should not stop you from living the life of your dream.

But personal finance management can and in some cases is a complicated process. The lack of constant control of one’s income and expenditures leads to inaccurate prioritization of funds.

At the same time, it should be clear that the concept of prioritization of finances does not coincide with restriction, and does not imply the complete exclusion of all goods from a person’s life. On the contrary, prioritization implies finding a balance between quality of life and frugality and taking into account long-term financial planning.

The role of the government in teaching personal finance is hard to overestimate. This is what it should do through schools and other educational institutions.

For more great articles from Thousandaire.com, consider reading:

- How Much Interest Will I Earn On $1,000,000?

- Can I live Off The Interest On $1,000,000?

- Millionaire Next Door Formula For Wealth Acquisition

- 3 Best Comic Book Album Binders

This article has been a guest posting from Svetlana Sherstobitova. Svetlana Sherstobitova is a financial consultant who prefers to present complex topics in simple language that is initially understandable to the audience.

This article has been a guest posting from Svetlana Sherstobitova. Svetlana Sherstobitova is a financial consultant who prefers to present complex topics in simple language that is initially understandable to the audience.