I was reading the New York Times (online edition of course) like any good nerd would do, and I came across this very interesting article about retirement savings. It warns people that most retirement calculators call for your investments to double in the last ten years of retirement.

Well, duh.

These calculators work on the premise that your investments double about once every 8-10 years, not just in the last 10.

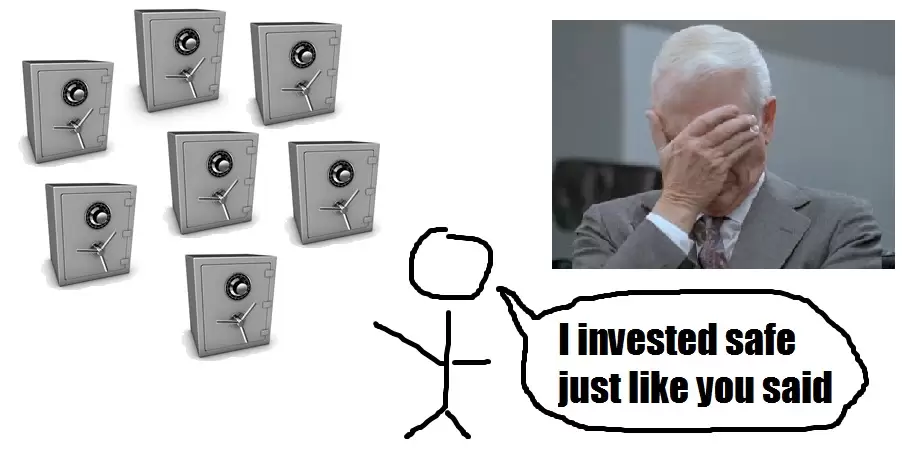

It is true, though, that a smart person will probably invest in less risky assets as he or she gets closer to needing that money as a source of income. I don’t know if a sprint to the finish the is best way to plan for retirement, but I think a quick jog is reasonable.

A 100% return in 10 years requires about a 7.2% annual return. That’s a very plausible return when you are investing aggressively, but maybe a tad bit high if you’re in the old, boring, conservative boat. I think a very safe profile of bonds and dividend stocks should be able to return at least 6%, but to be honest I don’t know much about it because right now because I’m 25 and risky.

Despite my aggressive investment behavior today, I fully intend to de-leverage my risk level and get into some safer investment vehicles when I get closer to retirement. If only there were a retirement calculator that could account for risky investments at the beginning of your career (higher rate of return), and safer investments at the end (lower rate of return).

Despite my aggressive investment behavior today, I fully intend to de-leverage my risk level and get into some safer investment vehicles when I get closer to retirement. If only there were a retirement calculator that could account for risky investments at the beginning of your career (higher rate of return), and safer investments at the end (lower rate of return).

Oh wait. It just so happens that I have a Retirement Calculator available for download, absolutely free, right here on my site. And what’s this? [download id=”5″] (download link) has an option to decrease your risk and return when you get older? What a great idea!

If you haven’t downloaded this spreadsheet yet, it’s (in my opinion) the best retirement calculator on the web. I made it because I couldn’t find anything that would model my future retirement and allow me to change so many different variables. you can change anything on this spreadsheet, so go crazy!

As I mentioned before, one of the really nice things The RC offers is the ability to change your return rate at a certain age, so you don’t have to model your whole life at the same investment risk level. Pick one return rate for when you are young, and then pick a more conservative one for when you are older.

I feel like the spreadsheet is pretty straight-forward, but if you are a bit confused with what’s going on, I made this helpful video that explains what all the inputs mean and how to use it.

I haven’t gotten much feedback on this spreadsheet yet, so I’d really like to hear your comments. Does this help you plan your financial future? If it could be improved, what would you like to see? I made this for you guys, so help me make it better for you!

Here’s one more download link for [download id=”5″]

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

When you retire at 65 or whatever, don’t you still have the next 30 years to look out for? And in the last 10 years, you want to stop investing in risky funds, but that leaves 40 years of mild gains. With that type of horizon, why not keep investing?

You’re not going to stop investing in more risky stocks because you have 30 years until you retire. Why stop once you hit 55?

The idea is that if you get to 55 and you have enough money to retire at 65 assuming a moderate return on your investment, then it’s better to reduce risk. If you have enough, then it makes sense to me that you would want to preserve capital and exchange that safety for a lower interest rate. I’m sure I’ll have some stocks when I’m older, but it will be much less than the 100% I’m holding now.

However, if you don’t want to reduce risk at the end of your career, The RC can model that as well. 🙂

This is great. I can see that this is going to involve some playing around time before I can give any meaningful feedback but it looks pretty straightforward. I’m looking forward to playing around with it. Thanks 🙂

By the way, I love your thank you page. Very creative.

I’m glad you like it. I’m interested to hear your opinion after you’ve played around a little bit.

Easier said than done. I think that if you’re in that position, great, but most people are struggling to make it to that point.

Kevin, Thanks for making this. I like the concept, but I’m having a bit of problem.

The withdrawal column looks wrong to me.

I’m 37 and I put retirement age and last year of contribution to 40. Pretty much left everything else the same for now.

The first withdrawal at age 40 shows 119,760. This is definitely wrong.

Have you seen the firecalc retirement calculator? That’s pretty interesting too. It would be really cool if RC can incorporate firecalc to show good and bad years.

The reason why you want to be safer when you near retirement is because you don’t have time to recover your portfolio if you hit a big dip.

Thanks for catching that error. I have fixed that and updated the spreadsheet. It should be working now!

Looks good man. Thanks for fixing it.

The thing that jumped out at me is the HUGE difference between taxed and tax deferred! I’m definitely putting off paying tax as long as possible on any future investment. That’s a free 25% gain…

Kevin,

Interesting article. It’s nice to read something positive regarding retirement these days. Has this retirement calculator been adjusted to reflect the current economic downturn? Do you feel it is still accurate? I’d like to retire in the next couple of years, but have some concerns about my investments.

Thank You

Nigel

I wish I knew about investments what I know now when I was your age. If I had started earlier, it might be feasible to retire at a younger age. Now schools are teaching kids these techniques, offering them real skills to use in life. They never discussed these important issues with us and often parents did not either. By the time I was 30, I realized I was falling way behind!

“I wish I knew about investments what I know now when I was your age. If I had started earlier, it might be feasible to retire at a younger age. Now schools are teaching kids these techniques, offering them real skills to use in life. They never discussed these important issues with us and often parents did not either. By the time I was 30, I realized I was falling way behind!”

I think the problem here is not you but the old education system that we had. For a long time I’ve notice that when we where at school we were not thought even just the basic of investing.

The rule of 72 can also give a quick answer to how long it will take your money to double dependent upon the current rate of return.

After all the negative things we hear and read about retirement, its nice to read something positive in that regarding.