An effective financial plan is one that incorporates all aspects of financial life and that includes goals that are specific, measurable, achievable, realistic and time-bound (SMART).

The 4 basic elements of an effective financial plan are situation analysis, goal setting, implementation and assessment. Each of these elements are important and interrelated and should be given proper attention.

The key to achieving financial freedom and success lies not only in the quality of the financial plan, but in the implementation of those plans. In addition, your financial plan must be documented and updated on a regular basis and should include short, medium and long term goals.

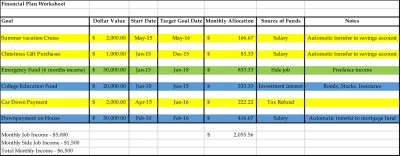

The following is an example of a financial plan template that is easy to use and that is color coded for short, medium and long term financial goals:

A simple financial plan such as this one may be created using Excel. In this example, short term goals are coded in yellow, medium term goals are coded in green and long term goals are coded in blue.

Situation Analysis

An effective financial plan begins with a current situation analysis. Since each person’s financial situation is different depending on income, financial obligations, and stage of life; the financial plan should be tailored to take those particular circumstances into account. For example, someone who is heavily indebted would need to take a different approach to financial planning from someone who has little or no debts at all. Similarly, someone who has more than one source of income may be able to take on more financial responsibilities than someone with only a single source of income. Situation analysis should involve taking a look at where you are financially in terms of your assets, your liabilities, your income and your expenses. This exercise will form the basis of all your financial planning decisions. At the end of the day, the aim of financial planning should be to at least put yourself in a situation of positive net worth and sufficient liquidity to comfortably cover your daily expenses. The situation analysis will help you to determine how hard you have to work to get to where you want to be and what it will require financially to get there.

Goal Setting

Goal setting is an essential aspect of financial planning. As mentioned earlier, your financial goals should be specific, measurable, attainable or achievable, realistic and time-bound. The example above is an excellent example of effective goal setting. Being specific means that you need to establish definite dollar figures for your financial goals. In the example, definite dollar figures were established for each and every financial goal eg. $30,000 for an emergency fund. This is a much more powerful and effective goal than simply saying that you want to set up an emergency fund. Also, you should be able to state exactly what you are working to achieve. For example, I want to save 6 months income as an emergency fund.

Establishing a dollar figure also means that your goal is measurable. A goal that cannot be measured is almost impossible to achieve because you will never know whether or not you have achieved it.

Your financial goals should also be attainable and realistic. In other words, if you earn $3000 per month, it may not be realistic to try to save $2500 per month. You must take your current reality into account as well as your future expectations. Goals that are not realistic or achievable will cause frustration and eventual failure. So be realistic even if it means that you will not achieve your goals as quickly as you would like to.

Your financial goals must have definite target completion dates. You must have a timeline within which you plan to achieve your financial goals. Otherwise you are likely to lose your motivation for accomplishing them. Setting a deadline gives you something to work towards and something to look forward to. It will allow you to make adjustments along the way if necessary so that you are still able to achieve your goals within the established timeframe.

Implementation of the Financial Plan

A financial plan without implementation is just a useless dream or wishful thinking. Unless you actually implement your plans, you will never achieve your financial goals. You must put measures in place to ensure that everything goes according to plan. Setting up an arrangement where your employer automatically deducts an amount from your salary for savings on your behalf, is a great idea if you don’t have the discipline to save on your own. Also, you can always make arrangements with your bank to transfer funds from your checking account to established savings accounts on your behalf. If you have a side job or do freelancing to make extra income, you need to develop the discipline to set aside amounts that will help you to achieve your goals. Funds that have been earmarked for something should never be used to do something else. Implementation of your financial plan will require great discipline.

Progress Assessment

For any financial plan to work, you must do periodic assessment to ascertain whether or not you are on track towards achieving your goals as planned. This assessment will give you the chance to make changes if necessary in order to ensure that your goals are met as intended. If your financial situation changes during the process, you may need to make adjustments to your goals. It is advisable that you conduct assessments at least on a monthly basis.

Insurance

Life Insurance is essential for any financial plan. Since nobody knows with 100% certainty what will happen in the future, it is important that you obtain life insurance so that your dependents will have a source of income should you pass on unexpectedly. Disability insurance and medical insurance are also great to have to help with unforeseen disability or terminal illness.

At the end of the day, a financial plan is only as good as the quality of the plan and your ability to implement those plans effectively. Each step in the financial planning process is important and careful attention should be dedicated to carrying out each step efficiently and effectively. Follow these steps and you will be well on your way towards achieving your financial goals.

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

I love the idea of creating SMART goals when it comes to financial planning. Unfortunately, alot of us just “hope” things will work out without taking actionable goals to making it work.