21st-century consumers treat the hunt for online bargains like a time-constrained religious experience. Potential transactions are taken for granted and automatically viewed as gospel. This is how money gets wasted. The problem is little patience for comparison shopping. Most people browse a website for 7 seconds before going to another. Only 14% of consumers bother to “comparison shop’ before purchasing. This issue has given rise to price protection apps like Earny. But is Earny a scam?

To answer that question, we must first delve into the issues of unmindful consumer purchases and price protection services.

Consumers like you, and even me, waste a lot of money every year on purchases.

That is because of the failure to “comparison shop” and the need to buy impulsively.

Have you ever bought an expensive purchase and found out later that it was on sale much cheaper elsewhere?

This problem gave rise to the need for price protection services and apps.

The problem with credit card price protections is that they are not uniform.

Every credit card company has exacting standards, qualifications, and limits for price protection refund redemption.

This issue has given rise to popular price protection apps like Earny. Some consumers can get up to $300 in refunds annually using the app.

However, Earny’s convenience comes at the price of privacy.

Is Earny a Scam?

Is Earny a scam? That may be the wrong question to ask.

When you use Earny, online privacy issues and conflicts arise which can give the impression of the app being a data mining scam.

Also, only the basic price protection service offered by Earny is free. The annual subscription is almost $50.

You shouldn’t ask, “is Earny a scam?”

Ask if it’s a worthwhile app to own if you’re savvy enough to save money on your own with self-initiated comparison-shopping practices.

You know what? We’re getting ahead of ourselves.

Let’s talk about Earny in more detail.

What is Earny?a

Earny is a price drop locating and price protection app.

Earny is an app that is optimal for use by those who charge for online purchases. This app is useless for cash purchases.

After you make an online purchase, you are usually sent an automatic receipt to your email inbox.

Earny scans your email account for digital receipts. Then the app scours the internet looking for price drops or cheaper discounts on your purchase.

The Earny app analyzes all of your emails and can even compose emails on your behalf. Earny writes emails on your behalf to negotiate with retailers.

This app will digitally scour every return and refund policy relative to your online purchases via your email.

When Earny finds a price drop on a purchase you made online, you will be sent a refund within 7 to 10 days.

You give Earny complete control over your email for the sake of acting as a digital comparison-shopping monitor.

Is Earny a Scam? (No – But is it Practical?)

Now, is Earny a scam?

I don’t think so.

The issue with this app for you will be privacy, price, and practicality.

Earny and Privacy Issues

People may ask, “Is Earny a scam?” because of privacy issues.

This isn’t just about registering with Earny.

Earny will send emails to retailers, relative to securing refunds, under your own name. In reality, Earny commandeers your email and can send emails under your name unbeknownst to you.

Some consumers have even complained that downloading the Earny app gives it the ability to delete your emails at will.

Price

Earny’s Lite plan is a free and basic app. You don’t have to pay a fee for service.

However, the Earny Lite plan will only track online purchases.

To get refunds and online price drop scanning services, you must register for paid subscription services.

Is Earny a scam? Well, it would have to be a self-initiated scam.

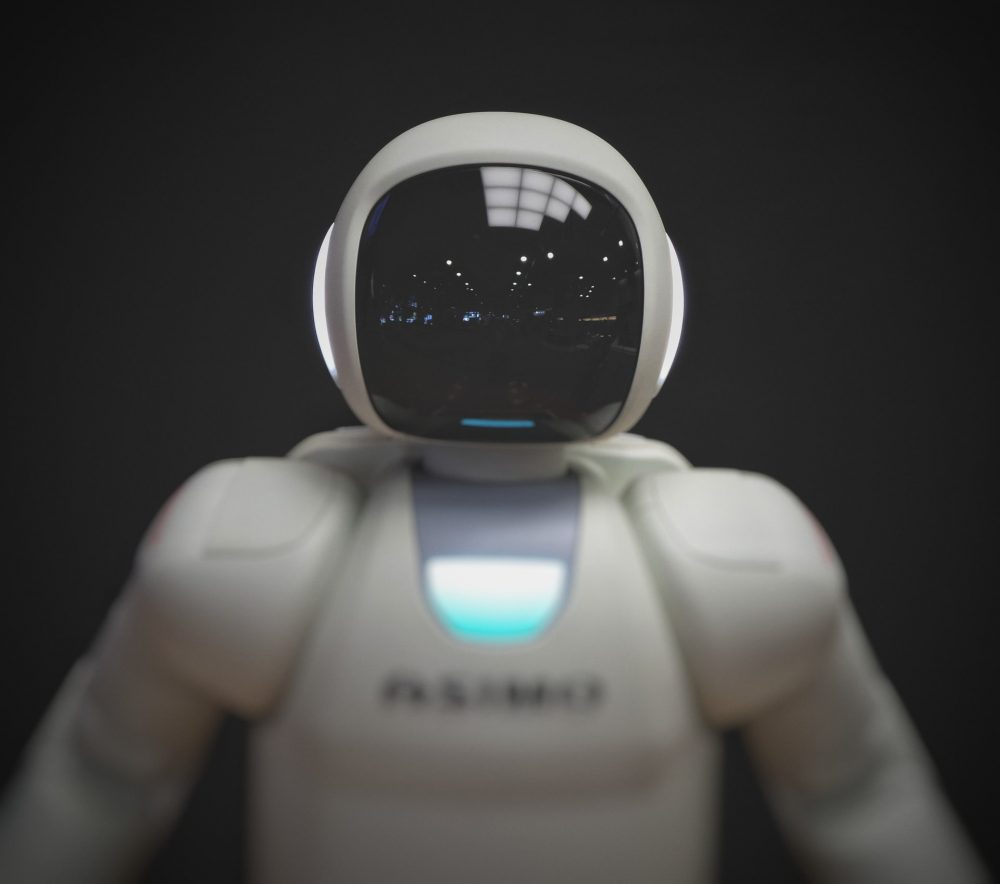

You are basically co-opting your own responsibility as a consumer to “comparison shop” to an app with near A.I. interactivity.

This brings us to the issue of practicality.

Earny’s Practicality

As I mentioned before, I don’t think that you should be asking, “is Earny a scam?”

You should consider its practicality for your needs before getting it.

For one thing, the Earny app will take complete control of your email. It’s a data mining and price protection app in reality.

An annual paid subscription costs $47.99.You may get over $300 annually in refunds.

Think about that. You would have to be pretty bad at shopping, and good at overpaying, for a near-sentient app to get $300 in refunds annually for you.

If you don’t have time to “comparison shop” online, Earny might suit your needs.

Otherwise, you can just save more money, and privacy, by comparison shopping yourself.

Read More

Beware the Card Cracking Scam That Makes Victims Accomplices

These Vacation Scams Will Threaten To Ruin Your Bank Account

How To Buy A Used Car And Not Get Ripped Off

What to Do if You Forgot to Cancel a Trial Subscription

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.