I recently took a loan from my 401k to buy my first house (which is closing next week and I’m super excited about) and one of the reasons I’m comfortable using 401k money now is because I have no idea what the government is going to do with retirement funds in the future.

The other day I read an article suggesting that President Obama wants to nationalize all 401k, 401b, and IRA accounts, force people to invest in government bonds, and institute a 100% early withdrawal penalty and eliminate the option of taking a loan from your account.

That would mean the government would take your retirement savings, spend it on whatever it wants, and give you an IOU that is redeemable when you are at the retirement age.

Before you get too worried about “Now Obama Wants Your 401k” it should be noted that as far as I know Obama never said any of this.

The author of the article is trying to paint a very scary picture, but the only proposal that has come from Obama and the democrats is automatically enrolling employees without an employer-sponsored retirement plan into a direct-deposit IRA. Employees would be given the opportunity to opt out of this (if it ever were to become law).

The other stuff in the article talks about how certain unions and organizations would like retirement income to become a government entitlement, as opposed to a privilege for those who make responsible financial decisions before reaching retirement age. While these organizations do support Obama and the democrats, I’ve found nothing yet that suggests Obama would adopt these proposals and try to pass them.

But what if he did?

Your 401k and/or IRA Might Not Really Be Yours

The current laws of the United States say that the money in your 401k is yours. That’s a fact.

You can take loans against your 401k or withdraw the money early if you are willing to pay taxes plus a 10% penalty.

But tomorrow those laws could be different. What if popular opinion says that it’s not fair for some people to have 401ks when others don’t have any retirement money? What if the government decides that they are too far in debt and they need money, so they pass a law that says all retirement savings must be invested in US government bonds and early withdrawals are not allowed?

You wouldn’t be able to stop it.

The government does what it wants.

All of us responsible savers who use 401ks and/or IRAs (myself included) are using these financial vehicles simply hoping the laws that govern these accounts will remain favorable to the individual saver.

I honestly don’t know if that is a safe assumption.

What to Do if You Don’t Trust Retirement Accounts

If 401ks and IRAs aren’t safe, then what is? Again, we have no idea.

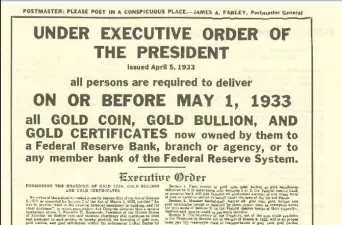

Gold probably isn’t safe either.

In 1933 the government made it illegal to own gold; specifically more than $100 ($7,800 in today’s dollars) worth of gold coins. Anything more than that had to be sold to the Federal Reserve at $20.67 ($371 today) per ounce. Violators could be fined up to $10,000 ($178,000 today) and/or be placed in prison for up to 10 years.

If they did it once, they could do it again.

Unfortunately, we can only live according to the laws that are on the books right now and keep a watchful eye out for any new legislation that is proposed in the future.

Personally I will continue to use my 401k and my Roth IRA, but if I ever read something that even suggests the government is actually considering legislation to restrict access to retirement funds, I will pull my money out immediately; long before anything is ever put to a vote.

Paying taxes and penalties on getting my money now is MUCH better than having that money locked into an account I can’t touch for decades.

Readers: Do you think the government will come after retirement savings? How would you feel if they did?

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

I don’t think you should worry about these things. If the government wanted to they could make us all do the chicken dance at every red light but it wont ever happen. I think time is better spent focusing on what you can control.

Like I said in the article, I’m not suggesting I want to drain my accounts now. I just think it’s important to keep an eye out for this stuff, especially in today’s environment where the government spends way more than it makes and needs to find money somewhere to finance all the crap it does.

Looking at the poll results from the linked article – by far the largest percentage says:

“Yes, everything about Obama is evil, and this is just another example “(42%, 477 Votes)

No further comment needed.

This isn’t just about Obama. He’s only around for the next 4 years. He might decide to overhaul retirement accounts or he might not.

I’m 27 years old. I’m gonna go through at least 5 more presidents and 19 more congresses before I hit 65.

It is a fact that there are people out there who want to get rid of personal retirement accounts, and they might find themselves in power at some point. I don’t know why you decided to fixate on Obama, because I made it very clear in this article that I wasn’t fixating on him.

You’re missing my point, Kevin, just as it appears that you think I missed yours. Your original comment was motivated by an article about Barack Obama that made wild assumptions based on no evidence. It may well be that “there are people out there who want to get rid of personal retirement accounts.” There are also people who want to get rid of social security and Medicare as we know it. They were beaten in the last election, because the opinion of the voting majority does carry weight. The point I wish to make is that radical changes like “getting rid of personal retirement accounts” are at best highly unlikely given the nature of our political process.

The article states, “The FY 2013 Budget proposal notes that currently 78 million working Americans, roughly half of the work force, lack employer-based retirement plans.”

If the voting majority doesn’t have employer based retirement plans, then it stands to reason that the voting majority may not be very concerned with maintaining individual ownership of them.

Again, I’m not saying it will happen. I’m saying it could and that people should be on the lookout for early warning signs.

“If the voting majority doesn’t have employer based retirement plans, then it stands to reason that the voting majority may not be very concerned with maintaining individual ownership of them.”

No it doesn’t. That’s assuming correlation equals causality, and there could be any number of other reasons why people don’t have employer based plans: poor financial education, employer fails to offer a plan, inability to plan beyond current expenses, etc. And if the voting majority is not concerned about individual ownership, it may well be because there has been no move on the government’s part to strip away ownership; if anything, the government’s prevailing position onthe matter has been to get people to save more. As you rightly say, people should be on the lookout for early warning signs. But absent such signs, people should not assume the chimerical.

I don’t see something like this ever happening in our lifetime unless the country was taken over or there was some global crisis like nuclear war or something like that. If either of those things were to happen, our problems would be so severe anyways that I think we’d all have money problems. I’m not sure you can or should plan for those things, so if you believe that the world will continue in some normal fashion, I think the likelihood of this is so slim that there’s no way I would put any strategy in place that would even take this into account.

I bet people in 1932 never thought the government would make it illegal to own gold, but that happened.

If you’re looking for a crisis that could make this happen, look no further than the debt crisis. Our government is borrowing 40 cents of every dollar it spends. If people decide to stop lending to our government willingly, then they will have to either cut spending or force citizens to “lend” them money.

My bet is on the latter before they cut spending. Especially when they can sell 401ks and IRAs as “financial vehicles for the wealthy”.

“I don’t see something like this ever happening in our lifetime”

Kind of reminds me of “It Can’t Happen Here” by Sinclair Lewis. We usually deny it until it’s printed in a history book somewhere.

The left continues to only want to grow the size of government. The dependent left doesn’t mind because they are getting the spoils and not paying. The power left love it because it ensures they’ll get elected for ages. All the head Leftist is talking about is raising taxes. He has no interest in stopping spending or fixing the economy. I could definitely see 401Ks on the table in the future. They are going to have to get their income from somewhere, and just like the “rich”, the 401K class will be powerless against the dependent Left majority. All you have to do is look at Europe. Hopefully it just takes a really long time to get there.

I think certain groups in this country have done a great job of turning this idea of “fairness” into a virtue.

Until we, as a country, start understanding that social tolerance and private property rights (including the right to the fruits of your labor) are ESSENTIAL to living freely, then there is nothing the government can’t touch.

I have yet to comment on this site. For some time i questioned what your views were, but understood that we all bring different things to the table. After the post trying to justify your 401(k) loan to the world and now telling us that the sky is falling and our retirement accounts will ultimately belong to someone else, I like a previous reader will bow out and refrain from visiting this blog.

Sorry to see you leave.

If the government does change the 401k and/or IRA laws, I wonder if you’ll come back.

Doubtful

That’s interesting. Just because you disagree with me now, if I were proven right in the future you’d rather continue to ignore me than think that I might see things you don’t and you might learn something.

It’s not something I would do, but to each his own.

I’m not going to worry about this. Not because I believe it’s an impossibility (though I do think it’s incredibly unlikely that this will happen in our lifetimes), but because there are enough things in my life I need to worry about, so why waste time worrying about things I have no control over?

I don’t think that the gold example is a good one. There are lots of examples of presidents using executive orders to to abhorrent things (Japanese internment springs immediately to mind…same president as the one who issued the gold executive order, too) but this isn’t one of them. Executive orders are meant to have the force of law, but are usually intended to be temporary, which is why they’re issued in times of war or national crisis. The Depression constituted a national crisis where immediate action needed to be taken. Preventing people from hoarding gold was an important step in keeping the economy from spiraling downward any further.

As for the 401(k) thing…I think you’re getting a little close to the edge, Kevin. Please don’t fall off!

First – if the Gov messes with my 401k, it will be through taxes. And frankly, I respect the right of the government to tax me.

Second, the chances of anyone ‘taking’ my 401k is roughly the same as the zombie apocalypse. Sure – it could happen, but it’s not real likely.

I definitely don’t think the government will come after 401k’s after all they will eventually get their money from you in that type of vehicle. Now Roth IRA’s might get phased out eventually. Also, you’re very brave for taking a 401k loan to buy a home. Very brave my friend.

This trial balloon has been floated a couple of times by an academic article or opinion piece. It’s possible, but we’re probably a long way from it. If we start to see more chatter and debate and campaign positions taken by slick populists along the lines of replacing “risky” 401(k) plans with “safe” government annuities, then best to take heed.

Hi All,

Just for your information, the above described scenario actually happened in my country – Hungary. As the author said the government can do whatever they want, and maybe the time comes for America when 80% of the voters want to merge all the 401k into one common pot. Because they don`t really have any savings….

At my age of 18, government said they cannot enroll any more people in the social net, so everybody was forced to start a private retirement account so do I, but we all still had to contribute to the big pot too via mandatory employer deductions.

I could save $20k (that`s a lot in Hungary) by the age of 30.

Then government made a law and forced every bank to direct the private accounts to a government account. It took place maybe in a week or two and I was down to zero. But finally they let me enroll to the social retirement plan, so I did.

When I retire in 40 years theoretically they`ll take care of me.

Since then I moved to the US, and one year ago they passed a new law, that everybody must have at least 7 years of prior contribution otherwise opted out from the national plan again 🙂 So here I`m with bare ass.

Should I start building 401k ? no way, I don`t care about the tax benefit. The current tax is a joke anyway. I pay maybe 10% total, as I cannot reach the 25% bracket.

I donno Kevin.. although I do mentally write-off my entire 401K, and there is a good chunk of change in there b/c I’ve maxed it out and never raided it for 13 years, there is no way in hell the gov’t would take it away. Maybe tax further, but nothing more.

Sounds like a justification to me Kevin! It’s always best to buy something when you can afford it imo!

Sam