I paid off $33,850 of student loan debt in just over four years. Here’s Part 3 of how I did it.

My first step in paying off student loans was to aggressively pay off my high interest debt. The next step was to make minimum payments while I (unsuccessfully) invested in the hopes of higher returns.

The third and final step was:

Put Every Extra Dollar into Paying Down Debt

In August of 2011, I still had about $20,200 of student loan debt to pay off. After making minimum payments on my debt for a long time, I finally decided that my financial goals had changed a bit:

- I wanted to increase my cash flow

- I lost my confidence in the stock market

- Therefore, I wanted to eliminate all my student loan debt

On September 27th, 2011, I decided that the economy was crappy and that I didn’t trust the stock market. I would rather pay off student loans at less than 4% interest than invest in the stock market (side note: as of 6/17/12, the S&P 500 is up 15.47% since 9/27/2011).

I paid my bills, I kept investing in my 401k, and I put every other spare dollar I had in a savings account so I could stockpile cash for paying off loans.

I paid off about $4,700 worth of student loans in September of 2011. I paid off another $3,300 in January 2012. Then I paid off yet another $3,400 in February 2012.

That’s over $11,000 of huge lump sum student loan payments in six months (not to mention still making minimum payments on remaining student loans). That left me with about $7,200 worth of student loans remaining.

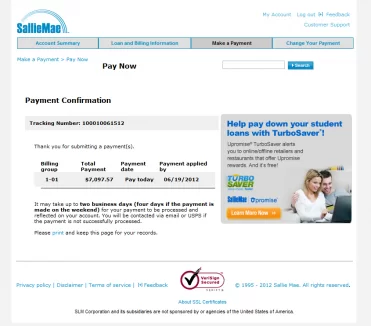

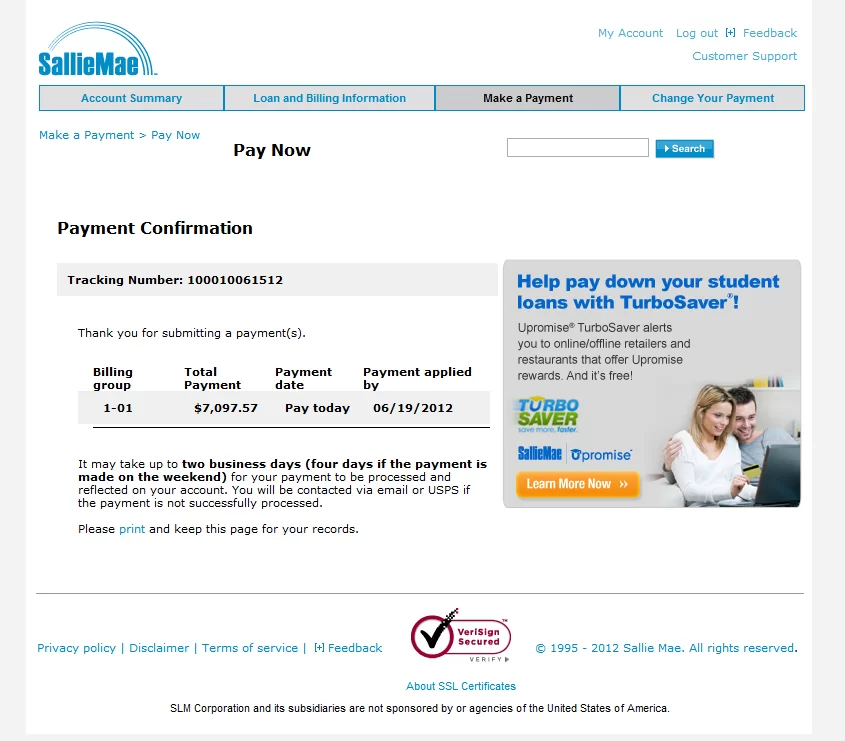

I had a few expenses pop up, such as a trip to Mexico and a bunch of new furniture for my new apartment, but outside of those expenses and paying bills I’ve been hoarding cash to make that last student loan payment. And I’m happy to say that on 6/15/2012, I made my final student loan payment.

I’M DEBT FREE!!!!!

It’s a great feeling to know that I don’t owe anybody anything. I know that when I earn $1 I get to keep everything the government doesn’t take from me in taxes. I know that I’m no longer working to pay off debt, but I’m working for myself.

Finally, if you are serious about getting out of debt, consider reading Dave Ramsey. He is the go-to guru for debt reduction. His book The Total Money Makeover has some pretty good methods for paying off what you owe. So pick up a copy if you get a chance.

Readers: Tell me congratulations on paying off over $33,000 of student loan debt in just over four years. Thanks!

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Congrats is definitely deserved whether you asked for it or not. It will feel great when my girlfriend’s student loan debt is gone but she owes quite a bit more than you owed.

Well done Kevin. That plan was ambitious and it worked out. Thank you for laying out how you did it. It was very educational.

Hey Kevin, I have a question for you about your loan pay-off approach. What made you decided to stockpile money in a savings account? Were you able to find a savings account with interest that beats your loans?

I am nearing the end of my student loan demolition (and it feels so good!). I am allowed to make as many payments as I want towards my govt student loans, so I usually make 2 or 3 payments a month, as soon as I get my paycheck. I do this to lower the compound interest.

I am just wondering what the benefits for you were to save and do big payments, versus lots of smaller payments along the way.

I would have saved a few pennies in compound interest if I had made more payments instead of lump sum payments, but I had a few reasons not to.

First, Sallie Mae has a promotion where they’d give me 3.3% of the original balance of one of my loans if I made 33 ontime payments, so I wanted to wait and make minimum payments to ensure I got that credit.

Second, I wanted the flexibility to use that extra money on other things if an emergency came up. Once you send that money to the student loan company, you can never get it back. If there were some type of emergency that cost me a lot of money, I didn’t want to have to pull from my Roth IRA or take out a loan to meet those obligations. The flexibility I had was worth the few pennies in interest it was costing me to pay in lump sums.

Finally, my interest rate was 2.38%. Lower interest rate means compound interest is much less impactful.

If you aren’t worried about needing a large lump sum of money for an emergency or if you have a separate emergency fund already, then your method is great and saves a few bucks.

Interesting, thanks! Yes, that is quite a low interest rate. Congrats again on your accomplishment!

congrats!

Congrats on paying off $33k of debt in 4 years. haha

I believe the instructions said to congratulate me on paying off OVER $33k of debt in 4 years… 🙂

Actually it’s…. congratulations on paying off over $33,000 of student loan debt in JUST OVER four years! Ha

Lol, My bad

Congratulations on paying off over $33,000 of student loan debt in just over four years!!!!!

Great effort equals great results, congrats on the massive effort. I am burdened with only student loans as you were just a few days ago. But I am paying them down somewhat aggressively and I will increase it as time passes. One day I will have a similar post just like this. DId you use any cool calculators to tell you how you were progressing with the debt?

“student just over congratulations on off paying four years over $33,000 of loan debt in”

There, are you happy now?! But seriously, congratulations!

What a great feeling it must be to have no debt! Your hard work has clearly paid off – congratulations! It’s great to hear success stories like yours as they hopefully help other people who are still working to get to debt-free.

I will congratulate you for paying it off if you congratulate me for graduating with NO student loans.

(And you wanna hear something sad? My cousin and her husband went to a college where tuition was less than $5k/semester, yet somehow has a quarter of a MILLION dollars in loans. And they’re not an M.D. or anything!)

My heartiest congrats to you for your achievement. Debt is such a curse to mankind that we should try out every possible way to demolish it to the core. Saving every single penny in which ever way possible is important to get rid off debt permanently and I am really glad to see your courage and efficiency to that.

Marie

Congratulations to you. I’m happy for you. Now I know you’ll be able to sleep better. I wrote an article on paying off debt and I couldn’t agree more. I belief I can learn from you a lot, if you have the time, just drop by my blog and check it out. I’m a newbie to blogging and writing is what I love doing. Thanks and I hope to hear from you.

Thanks for reading, and welcome.

You’ll find that I try my best not to give blanket advice because most situations are different. Unfortunately, that means I can’t really give you a great answer about grad school loans.

The most generic answer I could give is to say that it’s a bad idea to go to school without direction. Taking out tens of thousands of dollars in loans because “I don’t know what I want to do” is not a good decision.

However, if there is a specific job someone wants and they know they need a master’s degree to get it, then it MIGHT make sense to go straight to grad school (depending on how much loans they have and how much it will cost for the advanced degree).

If you want to email me more specifics about the situation I’m happy to give a more personalized suggestion.

Congrats Kev!

Congratulations on paying off your student loan debt! (Over $33,000 in just over four years? Very, very impressive!) You’re definitely a model for the rest of us who hope to be in your same position in the next few years!

Congratulations Kevin on being free from student loans. I have about 21k left to pay from my original 42k standford loans. My annual income will soon increase substantially and I have been weighing the pros and cons of taking a sledge hammer to my student loan debt – or instead… investing in the market. So… my question is simple. What changed your mind? I actually came upon your orginal post in early 2011 (I believe Jan) where you layed out the the math/argument behind investing versus rapidly paying off student loan debt. That post inspired many comments and opinions which you held strong in favor of minimum payments (and investing extra cash). I am trying to make you eat crow on that earlier post – just curious……

The answer to why I changed philosophies is a byproduct of a change in my financial and life philosophy.

Basically I have some future plans (hopefully near future plans) that make me want to increase my cash flow as much as possible and decrease my potential for defaulting on loans as much as possible.

Also, as I mentioned before, I really lost faith in the stock market anyway and didn’t think that was a safe place for all my money.

(Sorry Kevin – my post should have read “I am NOT trying to make you eat crow…”).

Thank you for your reply – I think you made a wise choice. Congrats again.