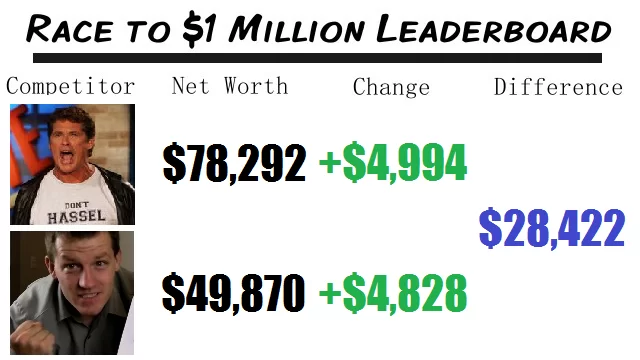

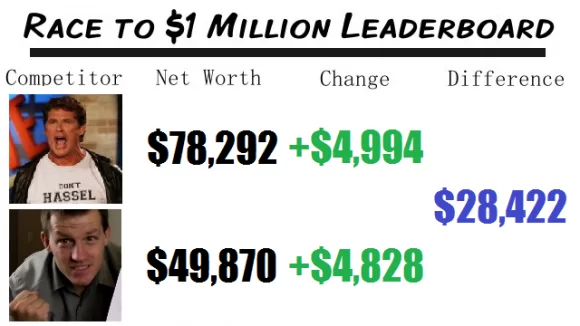

You might remember that this was a big month for me because I paid off the last of my student loans in June. While it was a big hit to my checking and savings accounts, it’s nice to finally be debt free.

But was paying off $7,000 of debt and getting 3 paychecks this month (yay for 5 Fridays) enough to beat The Hoff?

Unfortunately, it wasn’t. Crap.

Conspiracy Theory Tangent: Usually The Hoff tells me his number first and then I would look through my accounts and come up with my number, which in many cases back in 2011 was just a few hundred higher than The Hoff’s. This month I did my number first and he came back with a number only $166 higher than mine. I wonder if we can trust this “The Hoff” character???

Now that I’m done speculating about The Hoff cheating, I’m happy to report that after two months of my net worth decreasing, I’m in the black again.

Now I have some significant changes coming down the line that should have substantial impacts on future updates.

I’m Now $300 Richer a Month

This time last year I was paying $300 a month in student loan payments. In July (and every month in the future) I’ll pay $0 month in student loan payments. Not only do I have $20,000 less in liabilities, but I have $300 a month that I’m free to save instead of use to pay down debt.

$300 a month is $3,600 a year. That’s a significant amount of money, and hopefully it will help me catch up to The Hoff.

My 401k Strategy Has Changed

I’ll write more about this later, but I’ve made some pretty significant changes in my 401k investment strategy. This is hugely important because my 401k represents 47% of my total assets. A change in the investment returns of this account can make huge differences in future net worth updates.

I’ll detail what and why later, but I’m moving a lot of my money into Emerging Markets. Common knowledge says these are “risky” investments, but I’m actually moving into them because I feel safer with my money in Asia and Latin America.

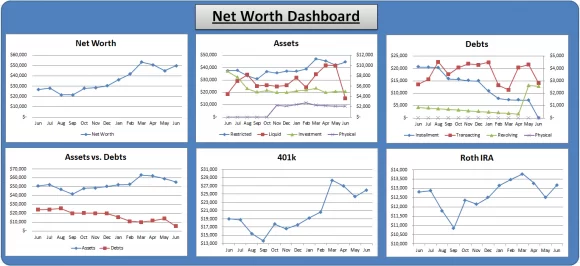

My Net Worth Tracking

As always, here are the net worth tracking graphs I use in my customized Net Worth Tracking Spreadsheet that is free to download. It’s fun to track this stuff, especially when the numbers are going up like mine have been!

Take a look at the student loan line that has reached $0. Pretty freaking sweet, huh!? You will also notice a huge dropoff in liquid assets (which were used to pay off the student loans). Everything else is looking pretty good. If you haven’t started your own spreadsheet yet, today’s a good day to start!

Carnival Links

Carnival of Retirement at I Am 1 Percent

Lifestyle Carnival at Young, Cheap Living

Yakezie Carnival at One Cent At A Time

Y & T’s Weekend Ramblings at Young and Thrifty

Carnival of MoneyPros at Simple Finance Blog

Carnival of Fin. Camaraderie at The University of Money

Carnival of Financial Planning at The Skilled Investor

Festival of Frugality at Help Me To Save

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children. Lastly, Kevin holds a B.A. in Mathematics and a B.S. in Electrical Engineering.

Glad to see the student loans gone and your net worth going up 🙂 Hopefully that $300 a month goes into something good or some well deserved treats.

I am sure that $300 extra will be huge! Congrats! I can’t wait to hear about your new investment approach.