Before I get into the really bad news about my net worth, I want to get into some great news about an article I wrote a little over a week ago. Brian Banks, the guy who was falsely accused of rape by Wanetta Gibson and lost 10 years of his life now has tryouts with four different NFL teams, an NFL trainer volunteering to train him for free, and even many other job offers if the NFL doesn’t work out.

Please read that article. The way he is handling the whole situation is simply incredible. The world needs more people like him, and I will be following his story closely and rooting for him.

Now that the great news has been reported, let’s get into some really bad net worth news.

May Was a Crazy Month

I usually have a few things going on that make my months financially interesting. This month was on a whole new level. I can’t even remember everything that happened, but here are a few of the things that have affected me this month:

- Moved into a new apartment

- Bought a brand new living room set (which I’ll write more about this week)

- Bought a brand new bedroom set

- Sold a bunch of old furniture for $310

- Bought tons of new odds and ends for my new place

- Ate out a lot because I was going back and forth from the old and new apartment

- The stock market had a miserable month

As you can probably tell, this wasn’t a very good month for me.

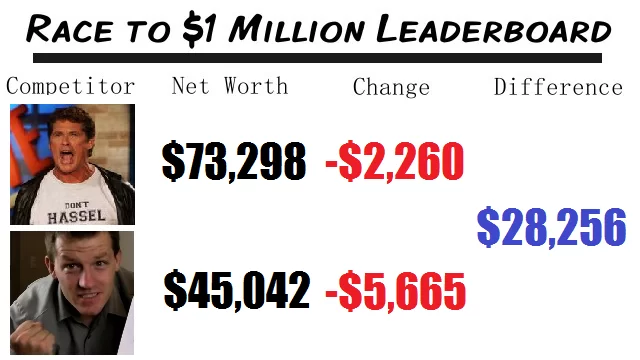

The Hoff Kicked My Patootie

There it is folks. I am now $28,256 behind The Hoff.

For those of you who have been around this blog for about 18 months, you might remember the very first update I gave on this race. The Hoff was beating me by $28,193. Now he’s beating me by $28,256.

Four months ago I had closed the gap to within $16,770. At that point I thought I might even be able to catch up this year.

Now I’m gonna be lucky if I finish the year any better than I was 18 months ago.

One Month at a Time

Now that the move is behind me, I can hopefully start gaining some ground again. I have quite a few good things in my financial future. For example:

- I should get at least $1,200 of income from building a wordpress site for a company and some advertising here.

- There’s a chance I will pay off the last $7k of my student loans by the end of the month.

- The next vacation I have is over 3 months away and is already paid for.

- I don’t see any more large purchases (like a new living room or bedroom) in my immediate future

- The Hoff and I have a tentative launch date for our new site in July. It’s coming up!!!

If all goes well, I should be getting back to the months of 2011 where I was increasing my net worth by at least $1,000 every month. Wish me luck!

My Net Worth Tracking

As always, here are the net worth tracking graphs I use in my customized Net Worth Tracking Spreadsheet that is free to download. It’s fun to track this stuff, especially when the numbers are going up like mine have been!

I won’t be pulling even with The Hoff this year, but at least I can show a big fat ZERO in the student loan line (blue installment line in the debts graph) and hopefully get more income from my new site! Wish me luck!

Carnival Links

Carnival of Financial Planning at My Wealth Builder

Carnival of Financial Camaraderie at Financially Digital

Yakezie Carnival at Daily Money Shot

Fin. Carn. for Young Adults at 20s Finances

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children. Lastly, Kevin holds a B.A. in Mathematics and a B.S. in Electrical Engineering.

keep working on it kevin, you’ll catch up to the hoff soon! The market was rough on everyone.

Yeah, and so was the new apartment. I’m just hoping his wedding in a few months is going to give me an opportunity to catch up a bit.

Hi Kevin,

Hope you are enjoying your new apartment. 11% is a big move on the net worth front. Do you have a breakdown of how your NW is split up?

HOpe the markets stabilize!!

Sam

The breakdown is in my net worth tracking sheet. There’s an image at the bottom of the post that splits it up pretty good.

The main thing you’ll notice on that image is that my revolving debt went from about $200 to about $2600. That’s because I put the new living room on a 0% credit card through Jan 2016, so it’s “revolving” at 0% per month.

That image also shows my 401k and Roth IRA performance, which as you can see is not very good in the last two months.

I see it now. Lots of images!

So, roughly $38,000 out of $45,000 is invested in the stock markets? If so, do you think that is normal for your age group, and/or folks in general in the US?

I’ve never gone past 40% of my NW invested in the stock market because of fear mainly, and interest in real estate and stable investments such as boring CDs.

I’m curious to know your perspective about the asset allocation percentage.

thx

I have about $59,000 in assets and about $14,000 in debts.

Of my assets, about $41,000 is in the stock/bond market , $15,000 is in liquid cash (checking and savings) or an HSA, $2,100 is in physical silver, and $500 is in Lending Club.

Within a month or so, I’m going to use some of my liquid cash to pay off the last $7k of my student loans, and after that I’m going to put some money in a new Roth IRA that invests outside of the stock market.

I agree that I’m probably overexposed to the stock market right now, but eventually I’ll probably drain my Roth IRA to buy a house and I can’t stop investing in my 401k because I’m getting a 100% match on 6% of contributions.

Gotcha.

You have more guts than me. I’ve become a cynic in the market after the past 15 years, so I don’t want to invest more than 35% b/c the market is out of my control.

Hey Kevin, I’ve been following you for a couple of weeks now. Can you catch me up on the race between you and the Hoff. Is this a friend that you’re competing with? I also keep up with a Net Worth now thanks to J Money with Budgets are Sexy and then I’ve been following your Net Worths as well. So thanks to you gentlemen for the work you are doing.

The Hoff is a buddy of mine and we are racing to see who can get to $1 million of net worth first. It’s a good way for me to make sure I’m always aware of how much money I’m spending/saving, and ensures I will update my net worth every month.

If you are interested, I recommend you try out my Net Worth Tracking Sheet. The graphs it comes up with are really cool.

What a great month – in terms of moving/buying stuff for your place. I always consider that a new chapter in life, and a new beginning – which is always a good thing. Next month will be better, I’m sure! You also have something to look forward to in 3 months!

Yeah, I’m happy with the money I spent. I knew it was going to look bad on the net worth update, but I have a really great place and I’m living with my girlfriend, so we’re very happy together.

If you succeed, let us know how you’ll pay off all $7K of your student loans this month!

If you look at the liquid cash line of my net worth dashboard, you’ll see it’s currently sitting at over $10k.

The only reason I’m waiting is because Sallie Mae has a promotion that I get a credit equal to 3.3% of the original loan amount for making 33 straight on time payments. My 33rd payment comes at the end of this month.

As soon as that credit is applied to my account, I’m going to pay off the rest of the balance entirely. 🙂

This month I paid off all of one debt ($646) and wrote a check for $2000 to pay off most of a remaining car loan. Thought of you!!!

That’s awesome! I’m actually a little sad that I’m paying off all my debt because I love to have a place to put my money where I’m getting a guaranteed return. Once the debt is paid off, I have to either accept 0.50% in a savings account or figure out a way to invest the money to return more!

Although, having no debt isn’t a bad problem to have. 🙂

Kevin,

You might want to look into rewards checking accounts. Use your debit card a certain number of times a month (10-15, usually), make a direct deposit every month, and there are a lot of banks that will give you 2.5% and higher. I think the program is called Kasasa Checking, and there are a lot of banks involved with it.

Stinks that your net worth went down but I have a curious question. While you did spend some money on furniture, and admittedly it isn’t worth what you paid for it anymore since it is used now, it is still worth more than $0. Do you include this in your net worth? I have to buy a new AC unit for my house soon and am pondering what to do with the cost of the unit. Add 1/2 to my net worth since I bought the house knowing I’d have to replace it (factored in to the price) or just expense it all and not add anything to my assets.

Personally I don’t add any of that stuff in. Sure it’s worth at least $1000, but I know I’m not going to sell it. Not only would it be really difficult to put a value on it, but then I’d feel like I have to value everything in my house.

It’s much easier to just consider the furniture, TV, computers, and everything else as an expense. Then if you actually do sell it, it’s a bonus! 🙂

I read one of your articles a week ago and it’s only now that I know of this challenge with Hoff. This is pretty interesting. A healthy competition brings a dose of daily motivation that is not only self-beneficial but affecting all others around you as well.

This post is very interesting. You surely have your hand on your finances. Currently, I’m working on fast tracking my debt payments like you. Being an emotional person, I have chosen the “snowball debt plan by Dave Ramsey.

Best regards,

Belinda

i had to admire your great effort, you have shared valuable information with us thanks for the good workhttp://www.celularesdesbloqueados.net