This month is going to be a doozy of an update. Here are a few of the things that happened last month:

- The Hoff had a bachelor party in Vegas that we both attended (where The Hoff drank heavily while I drank water)

- I had a vacation in Mexico

- The stock market was not very kind

I Won’t Be Catching Up This Year

So I had this crazy idea that I might catch up with The Hoff this year. I thought maybe because it is a no-donation year and because I’m starting to make a little size money that I could make up enough ground to catch him. It sounded like a good idea back in January.

Now I’m 5/12ths of the way through the year and I’m over $2,000 worse today than I was on January 1st. So much for his “expensive wedding” helping me catch up.

I’m Sick my Net Worth Going Up Slowly

Some people might call me crazy for being upset with my net worth increasing $20,000 in the last year. Sorry, but that just doesn’t cut it for me. Let’s look at some of the facts:

- I have a good job that pays me well over the average household income for Americans

- I have no children and live in Texas where the cost of living is very low

- While I’m not afraid to spend money on a good time, overall I’m pretty frugal

Let’s look at some of the expenses I’ll incur over the next 10 years or so:

- I hope to be married at some point in the next ten years, which means paying for an engagement ring and a wedding – not cheap but totally worth it

- I hope to have at least one or two kids, and every year those little guys are alive it’s going to cost me money

- I hope to buy a house, which is going to mean a big down payment, closing costs, upkeep, and all the other stuff that makes owning a home so expensive

The point I’m trying to make here is that I expect life to get more expensive over the next 1, 2, 3, 5, and 10 years. Sure I’ll probably get a small raise every year, and probably a promotion every few years or so, but my “back of the envelope” calculations seem to show that any increase in income is probably going to be offset with an increase in expenses.

Sure, if I get married and my wife has a job then her income is obviously going to help, and as my investment portfolio grows I can get more and more interest every year, but I’m pretty sure I’m still looking at my mid-40s before I get to $1 million.

I’m Going to Create More Income

Right now I’m looking at my mid-40s before I have $1 million in net worth. If I start living a crazy frugal life, I might speed it up to my early 40’s. That’s still VERY far away. I want this to happen sooner.

So as I’ve alluded to many times before, I’m spending all my free time building a new website. The new site is not like Thousandaire, which is purely content. It is a very useful, very unique, very free service that is going to TAKE OVER THE INTERNET.

Okay, it might not take over the internet, but I do think it will create a substantial secondary stream of income.

My Net Worth Tracking

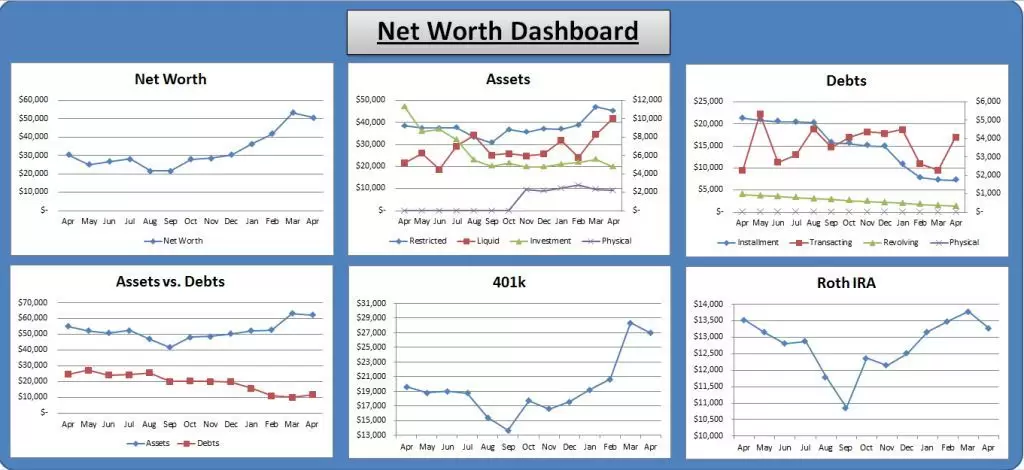

As always, here are the net worth tracking graphs I use in my customized Net Worth Tracking Spreadsheet that is free to download. It’s fun to track this stuff, especially when the numbers are going up like mine have been!

I won’t be pulling even with The Hoff this year, but at least I can show a big fat ZERO in the student loan line (blue installment line in the debts graph) and hopefully get more income from my new site! Wish me luck!

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children.

Good luck! However you define “good” that is. 🙂

Good luck! When do you think you’ll be finished paying down your student loans?

I hear you on expenses going up with income… My rent has gone up 24% since I started working full-time. My gross income has gone up 27%. A good portion of that has been eaten up by rent increases that are out of my control. And I’m likely to move to a bigger place, with a higher price range since I can’t find the square footage I want in my existing price range. Sigh.

There is no question that your financial world will get a lot more challenging in the future.. Expenses double when you get married, and they multiply exponentially when you have kids.. and you will need a bigger house, a bigger car, many more groceries.

You are wise to try to prop up your net worth now, before any of that happens 🙂

As the time is going for the change it also changing the business and corporate thinking to get the additional profit and this is increasing the challenges in the commerce.