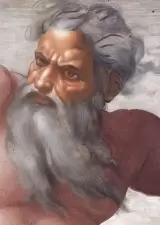

At some level of personal finance sophistication it isn’t necessary to follow every rule you hear religiously. That being said, if you’re regularly breaking these rules and you don’t have any good reason for why, you’re probably making terrible, terrible mistakes. But who am I to tell you what to do? These are the ten commandments, but no I don’t think I’m your personal finance god. More like Moses.

At some level of personal finance sophistication it isn’t necessary to follow every rule you hear religiously. That being said, if you’re regularly breaking these rules and you don’t have any good reason for why, you’re probably making terrible, terrible mistakes. But who am I to tell you what to do? These are the ten commandments, but no I don’t think I’m your personal finance god. More like Moses.

1. Thou Shalt Not Pay Interest on Credit Cards

There are two huge problems with paying interest on credit cards. First, people pretty exclusively buy consumer goods. If you can’t pay for the goods you’re buying, than you are by definition living beyond your means. Such a thing is the antithesis of good personal finance. Second, the interest you are getting charged is generally north of 10%. Paying interest at that level is a terrible idea because compounding just slaughters you. Do you know how many years it takes to double something compounding at 20%? Less than 4. Bad idea, bad idea, bad idea. Someone help your crazy, crazy brain if you’re paying interest but still using the credit cards to get points. Points are worth 1%. One month of interest will be 20%/12, and if you’re paying interest you’re not paying it for just one month!

2. Thou Shalt Not Pay Fees for Banking

Fees to do banking activities are sometimes worse than credit card interest. ATM fees are generally $2. If you pay ATM fees to withdraw, like $20, you’re giving up 10% of your money. Terrible idea. Same thing goes for overdraft fees. I once had a terrible checking account spiral when I was poor where I bought a $5 thing, but only had $4 in the account. Got slapped with a $31 fee, then deposited $10 and tried to spend the $10 thinking I now had at least $10 in my account. By the time the dust settled I owed the bank $150. I couldn’t afford the $5 thing I bought, and I sure couldn’t afford the $150 fee. If you’re otherwise careful the bank will usually let you out of the first one of these. If they don’t just switch banks. Also, if you’re still paying ATM fees switch to a high interest checking account that pays the friggin’ fees.

3. Thou Shalt Not Finance a New Car

In general if you have to take a loan to buy something, you can’t afford it. A new car is a terrible thing to buy when you can’t afford it due to depreciation and insurance. If you need something you can’t afford to replace, you must get insurance. Otherwise, one accident simply wipes you out. It’s not fun to make payments on a car you don’t own. I can hear the complaints now, “But Adam, I need a car”. You don’t need a new one. If you flatly need a car. First, try to live with a bike for a month. If your work tells you that they’re going to fire you, you can get a used beater for $500. If you just don’t like walking/biking for three hours both ways, tough. Get a closer job or move. Don’t glue yourself to your waaay too distant job with payments you can’t afford. Second complaint I expect to hear is, “But the interest is 0%, I could pay for it in cash, but why not take the loan and leave the cash in my high-yield checking account.” If you offer to pay in cash, you will get a better price. I absolutely guarantee it. Negotiate with cash, then see if they’d be willing to give you the 0% loan, will not happen. The reason for this is obvious. They assume risk with a loan and they have a cost of capital above 0%. Car dealerships have debts too, the 0% is just a method of tricking folks into paying the sticker price.

4. If Thy Employer Offers a 401K Match, Thou Shalt Contribute

You only get to pay interest on credit cards if you are forgoing this to purchase Top Ramen in cash and pay the rent on your camping spot in Kansas. In the case where you only have needs, credit cards, and a 401k match to get, prioritize the needs (if I think a house is a luxury, you can imagine how I feel about cable), then the 401K match, then the credit card debt. Then seriously look for a better job. You’re living in a tent in friggin’ tent in Kansas!

5. Thou Shalt Invest Prudently

All of this saving does zippo good if you end up just betting it all on black in Vegas. Playing the stock market is little better. Brokerage fees will eat you alive. If you don’t know what you’re doing leave it in cash. You have a new job for the next 3-5 years. Learn everything you can about investing. Prudently generally means that you aren’t looking to make more than a 10% return, and that you’re adequately diversified. If you’re trying to double your money over a year, and you’ve got it all invested in a sure-fire thing you aren’t being anywhere close to prudent. If you’re considering buying or selling an “option” or a “future”, stop; move everything to cash; look at yourself in the mirror and feel shame.

6. Know Thy Spending

If you don’t know how much you’re spending its real hard to make sure that you’re actually going to achieve your financial goals. Furthermore, its great to know how your spending breaks down so you know where you can save the most money. (For example, if you haven’t gotten rid of cable yet, just do it. You could get netflix and hulu and amazon prime for less. Maybe there’s some sports thing out there if you really need the sports. Cable might be costing you $720 annually. Boo cable!) I use mint.com for this. No link because it’s buggy and I don’t like it (Seriously, why can’t I just split the bills for a specific credit card. I’m a programmer, I know its not that hard.) I’ve heard good things about You Need A Budget.

7. Thou Shalt Read

It’s cliche but the best return on investment has always been reading, and assuming the rest of the US population insists on pretending that they’re illiterate, it will continue to be the best return on investment. People who insist on claiming that it’s who you know and not what you know really just seem like they would prefer not to read. At some point every endeavor comes into contact with reality. Reality doesn’t care who you know, it only cares what you know. Make sure you know things. From good will hunting:

…you dropped 150 grand on a fuckin’ education you could have got for a dollar fifty in late charges at the public library!

8. Thou Shalt Use Math

This is the other part about knowing things. The easiest way to handle most problems is with numbers. Problems that are totally intractable using English can be translated to math, solved easily there, then translated back to the real world. Basically all of modern society is based on how well that trick works. If you aren’t acquainted with math, its hard to get a good handle on personal finance. You don’t even need to know a lot of math, just all of the math in human history up until 1500 AD. Oops, I mean everything up to 8th grade. Some people say that you never use it after you get out of middle school. Those people are statistically poorer.

9. Thou Shalt Minimize Thy Tax Burden

Assuming that you’re following all of the other commandments, you can go ahead and do this. Probably, don’t make less money in order to drop into a lower bracket, you’ll still end up with less. There are a couple tax credits, like the savers tax credit, with sudden cutoffs. Use your tax sheltered space, like 401K’s, IRA’s and HSA’s to hit the breakpoints on this. At the margin, don’t sell appreciated investments in high quality companies. No reason to take the tax bite now when you could let it compound much longer. Organize your business to be tax efficient. Hire an accountant if your tax situation isn’t obvious. Pay the accountant lots of money, you’ll still probably come out ahead.

10. Thou Shalt Not Covet

Maybe you’ll notice I stole this one. As a commandment it’s great. Why do people get into personal finance messes in a world where even the very poorest are far, far richer than their great-grandparents. Anyone can live as people did in 1950 with the added bonus of the internet and waaay better healthcare and be saving substantial amounts of money. My only explanation is envy, covetousness. Get a handle on that and all the rest of these are far easier…

Adam Woods is a physicist. His research interests include building software to run and build geomagnetic models. Adam got interested in personal finance in the great recession when it became obvious an interest was necessary.

After harassing his friends and family (and a short intervention) he took to the web where he blogs about finance, investment, politics, and economics.

Adam is currently located in Boulder, Colorado where he can generally be found hiking, biking, or running a D&D campaign. He can also be contacted at adamwoods137@gmail.com.