Let me lay down some serious financial wisdom on you. Are you ready?

You can improve your financial situation by saving more money.

Boom! Spend less and save more for important things like paying down debt or a vacation or a brand new living room. It’s so easy!

So why doesn’t everyone do it?

It’s because spending is a lot easier than saving. We are assaulted with advertisements at all hours of the day. Grocery stores and gas stations lay out products specifically to subconsciously make you buy more stuff. Friends encourage us to hang out with them (aka spend money at a bar or restaurant). The impulse to spend is everywhere.

But what if you suddenly had an impulse to save?

ImpulseSave Makes Saving Easier

Being the world renown, ultra famous personal finance blogger that I am (pause for laughter), sometimes I get a first look at some interesting financial start-ups. One of them I like is ImpulseSave.

ImpulseSave has created a savings account that encourages you to reject impulse buys and turn them into impulse saves. It takes our spending culture and flips it upside down.

The concept is simple. If you have the urge to buy something, that means you’re willing to part with your money. But instead of actually buying that coffee, you can change your impulse buy into an impulse save and put that $4 in your savings account. It’s still gone out of your checking account, but it’s just put towards some bigger goal.

Why Impulse Save Rocks

ImpulseSave does a great job of creating a bank account that encourages people to save money. The psychology of saving money is one of the hardest things to crack, and ImpulseSave does it better than any other savings account I’ve seen.

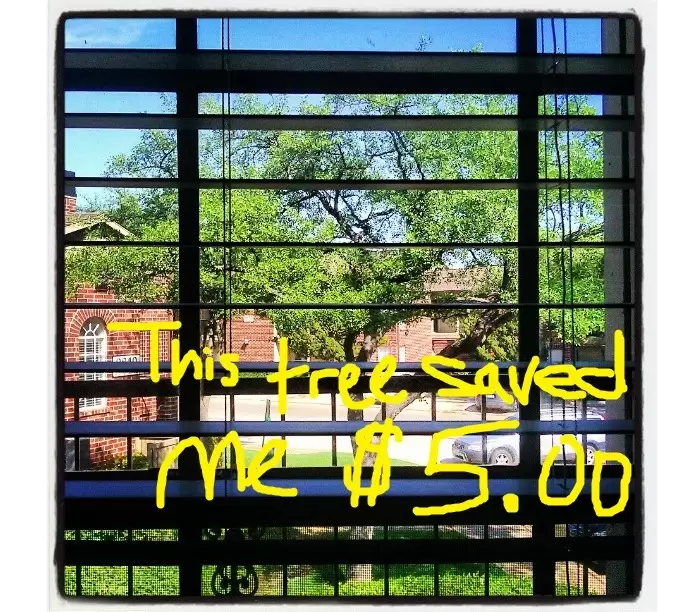

It’s easy (and actually kinda fun) to get on your phone and drop $5 or $10 in your account. Yesterday I took a picture of a tree and saved $5. Seriously, this is all you have to do:

If you feel like you spend too much and save too little, this is definitely going to help you turn that around.

Where ImpulseSave Can Get Better

I like this service a lot, but it’s a new company and unfortunately they don’t have a mobile app yet. Even worse for me and other Android users, the iPhone app is in the works and will come first, with the Android version coming later in the future. Luckily it’s super easy to ImpulseSave with a text or even a tweet, so this really isn’t a huge deal.

The other thing I’m not a huge fan of is the interest rate. It’s only 0.40%, where you can get around 0.80% in some other online savings accounts. However, 0.40% on $2,000 over the course of the year is literally $8. I have a feeling I’ll turn at least $8 of impulse buys into Impulse Saves over the course of a year, so I think I’ll actually come out ahead anyway.

You Can Try ImpulseSave If You Like

You can’t just sign up for ImpulseSave; you have to know somebody. Luckily you know me. If you want to try out this saving account and see if you can impulse save yourself some money, you can get access via this link:

https://impulsesave.com/mobs/

If you want to learn more about the ImpulseSave concept you can watch the video below, and if you want more information about exactly how the account works, you can see all the terms on their website.

Kevin McKee is an entrepreneur, IT guru, and personal finance leader. In addition to his writing, Kevin is the head of IT at Buildingstars, Co-Founder of Padmission, and organizer of Laravel STL. He is also the creator of www.contributetoopensource.com. When he’s not working, Kevin enjoys podcasting about movies and spending time with his wife and four children. Lastly, Kevin holds a B.A. in Mathematics and a B.S. in Electrical Engineering.

You can also setup automatic savings towards what ever goals you want!

How interesting kevin – that tree is going to turn you into a thousandaire before you know it!

World renown? Well, you already have at least one reader outside the US (me) 😉

An excellent way to save in this 0 interest rate environment is to work with payroll at your company to take out and extra $10 from each paycheck. When you get your taxes back, you will have another $520 saved.

Sounds like a pretty cool product. Might have to look into it more!

It is a really interesting idea. I’m not sure I really want to start yet another bank account of sorts. But kudos to them for trying to make people save on impulse!

Good one! It is all about reverse psychology, changing our behaviors to one that will assist us to achieve our financial goals. I will not forget this one!

ImpulseSave really reminds me of SmartyPig. Automatic saving is a great idea. My biggest concern with setting up an automatic savings plan is having an accidental overdraft. Instead of linking the account to my checking, I linked it with one of my saving accounts.With a savings account, I get up to 6 withdrawals and that’s plenty enough.

Congratulations. In this article you are trying a number of aspects that are important to all people think about retiring at some point. To achieve this goal, to save for the years to work. In this sense, it is very important that this saving is invested properly. With a population that lives more and more years and a government that has less and less money to subsidize and fund public services, we only have one option. Depend on ourselves.I am writing in my blog very often on this subject. The paradigm of savings in a mutual fund well diversified, has been destroyed. If we invest our savings in one of these funds, we get probably an average annual return of 3% or 5%. The bad news is that this kind of performance is not reached us to generate an adequate pension.Remember, we will live more years than our parents and we have a government with fewer resources. Consequently, we need a greater amount accumulated for our retirement. That is not possible with annual returns of 3% or 5%.This paradigm shift, we are forced to seek other investment vehicles for our savings. It will be necessary that we use some of our time in “watching” our investments.