It should also be noted that you can get crushed by the S&P 500 Index return as well. It is basically an article of faith in the personal finance community that one ought to invest in index funds, perhaps particularly the S&P 500 index fund. There are a couple advantages to doing so. It’s easy. It’s cheap. You get the average result.

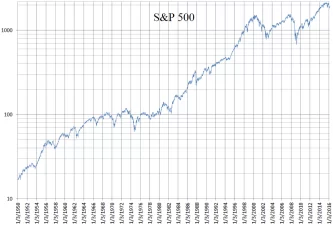

Most of my money is in index funds. That’s the case because most of my money is in a 401k type plan. Index funds are the only reasonable choice that I have from my plan sponsor. This is a good thing, I suggest you keep most of your money in an index fund. For example, here is the S&P 500 index return over the last 100 or so years

What the S&P 500 is

The S&P 500 is a collection of the 500 large companies selected by the S&P 500 committee to be representative of the US stock market. The major requirement is that the market capitalization (this is the combined value of all the shares of a company at the market price) is greater than $5.3 billion. The stocks in the index are then weighted by their market capitalization. This is convenient for index funds because they don’t have to buy or sell a little bit of a stock just because its price changes.

What the S&P 500 misses

In my view the S&P 500 leaves out two major types of company. Foreign companies (though 27 are currently included in the index), as well as small companies (in this case we’ll consider sub-billion dollar market caps to be small).

Large foreign companies can generally be invested in by choosing an international index fund like the Vanguard Total International Stock Index Fund.

To get exposure to smaller companies you could buy a small-cap index fund. You might want to do this because small capitalization stocks on average return more than larger capitalization stocks (about 3% more since 1930). Over long timescales that extra 3% really adds up. Think of it this way, if you expect to earn $700 after inflation from investing $10,000 in the S&P 500, you expect to earn $1000 from small cap stocks. Obviously returns are not that smooth, but that extra 3% is a very hefty amount.

The Problem With Small Cap Index Funds

My biggest gripe with small cap index funds is that they are still huge! The median market cap in the Vanguard small-cap index fund is $3.3 billion. There’s a lot of room below that. The problem is, if you get much smaller it’s very hard for an index fund to build a position. The bid-ask spread on tiny stocks can be very large, some days tiny stocks don’t even trade. If you manage an index fund and you have mandate to buy all of the stocks, how do you deal with this?

Often, you just don’t. You either hit the ask on these stocks and pay a huge spread, or simply do not invest in stocks with low liquidity. These frictional costs aren’t included in the expense ratio of the fund. These costs can be as much as 1% annually. Additionally, forced selling from these funds during market panics can push down the prices of illiquid stocks substantially.

How to beat these index funds

My investment philosophy is stems from a few simple ideas.

- The market is mostly efficient. Therefore most of the time buy and forgetting index funds is a great way to go.

- This efficiency comes from highly informed, highly skilled professionals who work against each other in the markets resulting in prices that very closely reflect true value.

- Areas of the market where highly informed, highly skilled professionals do not exist, or are severely constrained probably have significant mispricings.

- It is possible for an amateur to spend enough time and do enough research to identify these mispricings and exploit them for profit.

So I seek to invest in areas where professionals cannot or will not go. The most obvious area is nano-cap and micro-cap stocks. A mutual fund manager, no matter how intelligent generally just can’t invest in a company with a two million dollar market cap. If they manage $100,000,000, why are they going to spend years trying to build up a $100,000 position in a tiny illiquid company? The answer is that they simply will not attempt it.

This also means that they don’t bother trying to calculate the fair value of that company, and many companies like this can languish in obscurity for years with market prices far below fair value.

What if you’re wrong?

Now, to be fair, it could be that the market for nano-cap and micro-cap stocks is efficient. Maybe I can’t exploit mispricings for profit because maybe there are no mispricings. That could be true, but I would still argue that my practice of buying tiny stocks and sitting on them would still be a good strategy. There are a couple reasons for this:

- The small cap premium. Smaller capitalization companies are more risky, and therefore return more. As we saw earlier, this is about 3%. I would expect it to be higher for even smaller companies, if I’m wrong and the market is efficient. If two assets returned the same, but had different levels of risk, why would anyone invest in the riskier asset?

- Illiquidity premium. If your money is illiquid your investment is less useful to you. If two assets returned the same, but one was very liquid and the other you required you to sit with a limit order for 6 months to get your money out, why would you invest in the illiquid asset? Therefore, if the market is effecient there is some premium for investing in illiquid assets.

So therefore…

Heads I win, tails I win. I love situations were I can be totally incorrect and still win. Now, obviously investing in very small and illiquid companies comes with risk. It is totally inappropriate if you expect to need the money you’re investing at some point in the next 20 or 30 years. But if you’re investing for the long, long run I expect that analyzing tiny companies, buying good ones, and waiting until you’re very old will be more profitable than investing in the S&P 500.

Disclaimer

I have no positions in any index funds mentioned. I wrote this article myself, and it expresses my own opinions. This is not a investment recommendation. I am not receiving compensation for it (other than from the owner of the blog District Media Corp). I have no business relationship with any company whose stock is mentioned in this article. Always do your own research before making any trade, buying or selling any stock mentioned.

Adam Woods is a physicist. His research interests include building software to run and build geomagnetic models. Adam got interested in personal finance in the great recession when it became obvious an interest was necessary.

After harassing his friends and family (and a short intervention) he took to the web where he blogs about finance, investment, politics, and economics.

Adam is currently located in Boulder, Colorado where he can generally be found hiking, biking, or running a D&D campaign. He can also be contacted at adamwoods137@gmail.com.